Author : Saman Memarpour

December 2024 Petrochemical & Fertilizer Market Analysis

December 2024 was a pivotal month for the petrochemical and fertilizer markets, characterized by significant fluctuations in pricing, robust tender activity, and geopolitical influences. This article delves into the granular and prilled urea markets, ammonia price trends, and overall market dynamics. The insights presented aim to equip industry professionals with actionable knowledge and projections for Q1 2025. Detailed data visualizations and comprehensive regional analyses are also included.

Urea Market Trends

Pricing Highlights

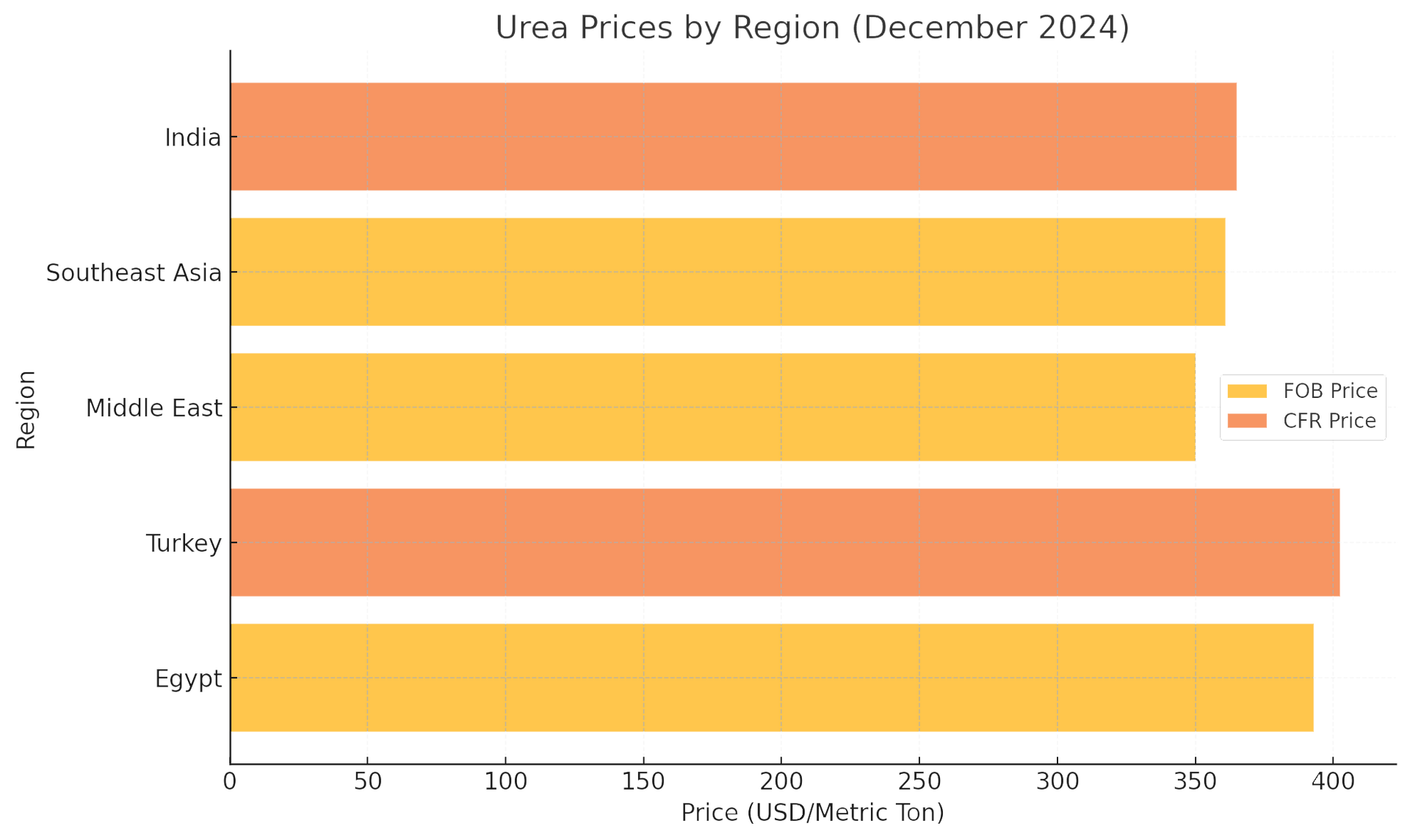

The urea market’s performance in December 2024 was heavily influenced by India’s major tender and fluctuating demand across global regions. Pricing updates from key markets are summarized in the table below:

| Region | FOB Price (USD/Metric Ton) | CFR Price (USD/Metric Ton) |

|---|---|---|

| Egypt | 393 | - |

| Turkey | - | 400-405 |

| Middle East | 350 | - |

| Southeast Asia | 355-367 | - |

| India | - | 360-370 |

Regional Highlights

- India: The NFL tender, amounting to 1.5 million tons, created substantial upward pressure on global prices, reinforcing India’s role as a dominant player in the fertilizer market.

- Middle East: FOB prices hovered around 350(USD/Metric Ton), buoyed by consistent demand from Southeast Asian markets and African nations.

- Turkey: A tight supply scenario drove CFR prices to 400-405(USD/Metric Ton), reflecting Turkey’s strong reliance on Middle Eastern and Egyptian suppliers.

- Africa: Seasonal agricultural demand underpinned steady trade flows, maintaining regional pricing stability.

Granular

vs.

Prilled Urea

Granular urea consistently fetched higher prices due to its widespread suitability for large-scale agricultural applications, particularly in Africa and Turkey. Prilled urea, while competitive, recorded FOB prices averaging 310(USD/Metric Ton), appealing to niche markets requiring finer particle size.

Ammonia Market Analysis

Price Trends:

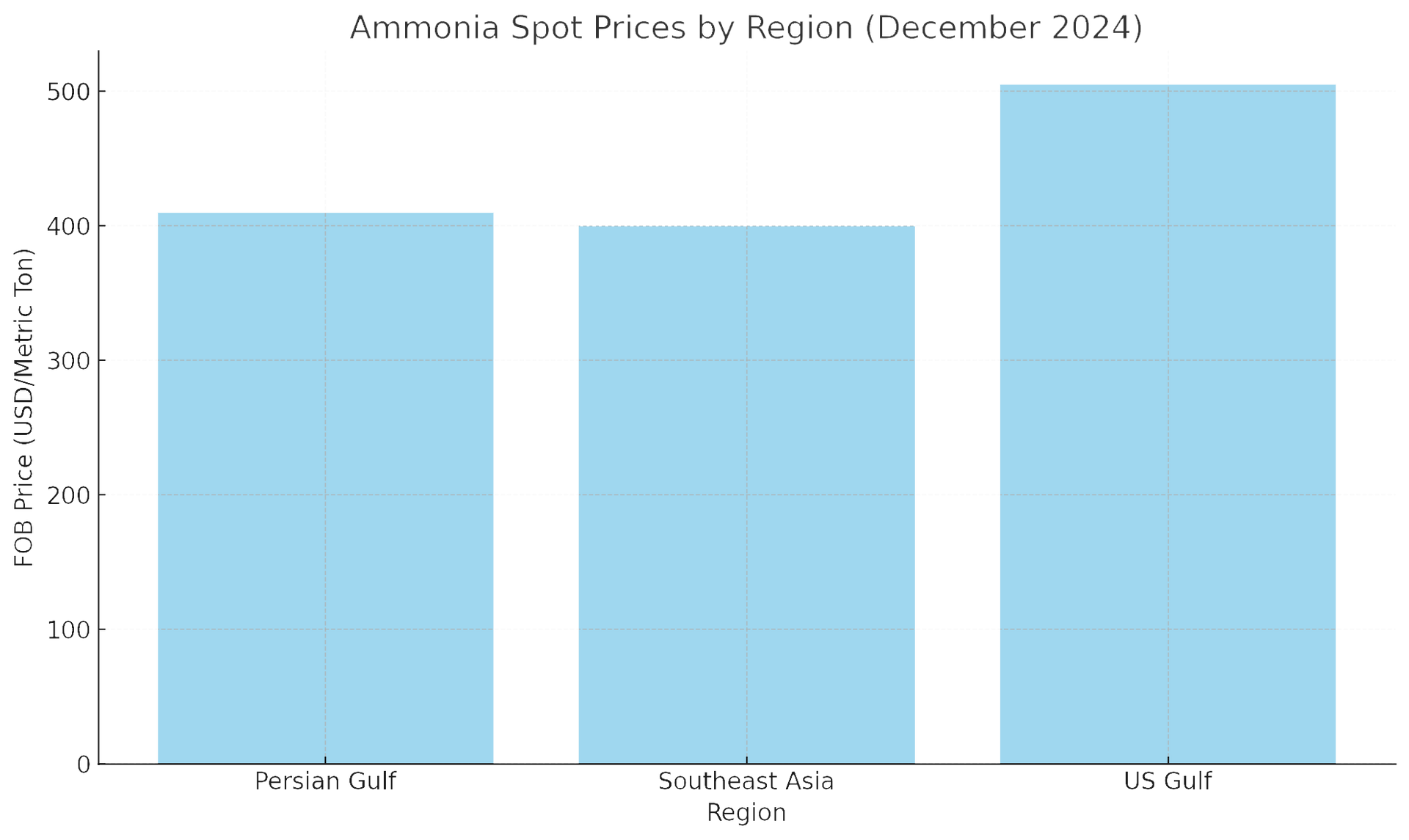

Ammonia prices showed a slight softening in December due to seasonal demand reductions and oversupply in key producing regions. Notable price ranges include:

- Arabian Gulf: FOB prices are 400-420(USD/Metric Ton).

- Southeast Asia: Prices ranged from 390-410(USD/Metric Ton) FOB, reflecting moderate demand from industrial buyers.

- US Gulf: Spot prices remained elevated at 500-510(USD/Metric Ton), driven by limited domestic supply and strong industrial usage.

Key Market Factors

Oversupply Dynamics: Increased production capacities in Saudi Arabia and Algeria contributed to a global surplus, placing downward pressure on FOB prices.

Regional Demand Variations: North African exports maintained competitiveness, balancing reduced European imports following a mild winter and lower industrial activity.

Future Projections

Ammonia prices are expected to remain subdued in Q1 2025 unless producers implement supply-side adjustments to mitigate the current surplus. However, anticipated recovery in industrial activity could provide mild upward support.

Key Drivers and Events

Indian Tender Influence

India’s NFL tender was a cornerstone event, securing 1.5 million tons of urea and stabilizing prices globally. Suppliers from the Middle East and Egypt reaped significant benefits from this procurement exercise, positioning themselves as reliable exporters to one of the largest global fertilizer markets.

Geopolitical Disruptions

Iranian export interruptions due to ongoing geopolitical tensions created temporary volatility, particularly in Turkey, which relies on Iranian supply for its fertilizer needs.

African agricultural demand surged seasonally, ensuring steady trade flows and price support.

Future Outlook

- Urea: Prices are expected to stabilize post-tender, supported by seasonal buying from Southeast Asia and Africa.

- Ammonia: Oversupply could keep prices subdued unless production levels are recalibrated to align with demand.

Data Visualization

Urea Price Comparison (December 2024)

Ammonia Spot Price Overview:

| Region | FOB (USD/Metric Ton) |

|---|---|

| Persian Gulf | 400-420 |

| Southeast Asia | 390-410 |

| US Gulf | 500-510 |

Conclusion

The petrochemical and fertilizer markets in December 2024 reflect an intricate interplay of supply-demand dynamics, regional procurement strategies, and geopolitical influences. India’s NFL tender set the tone for global urea pricing, while ammonia markets struggled with oversupply. Looking ahead, Q1 2025 promises a mixed bag of challenges and opportunities, with market stabilization expected in urea and potential adjustments in ammonia supply.

Staying informed about these developments is critical for businesses to navigate market complexities and capitalize on emerging opportunities.

References: