May 2025 Global Fertilizer & Petrochemical Market Report

Trends, Challenges, and Opportunities in a Shifting Trade Landscape

Author : Saman Memarpour

Executive Summary

The global fertilizer and petrochemical markets in May 2025 saw divergent pricing patterns, driven by key geopolitical and trade developments. Below is a data-supported breakdown of the month’s pivotal trends.

1. Urea Market Stabilization with Late Uptrend

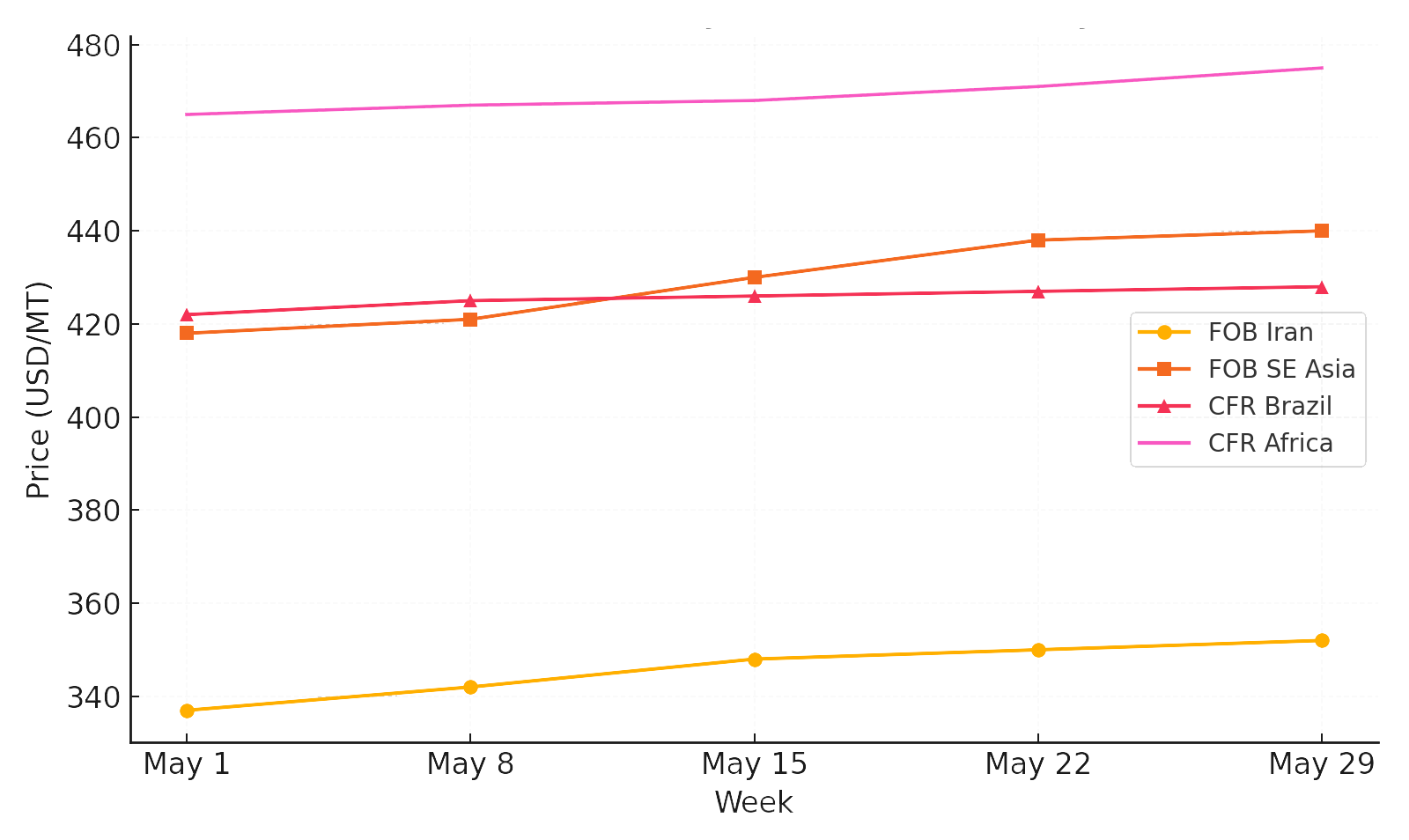

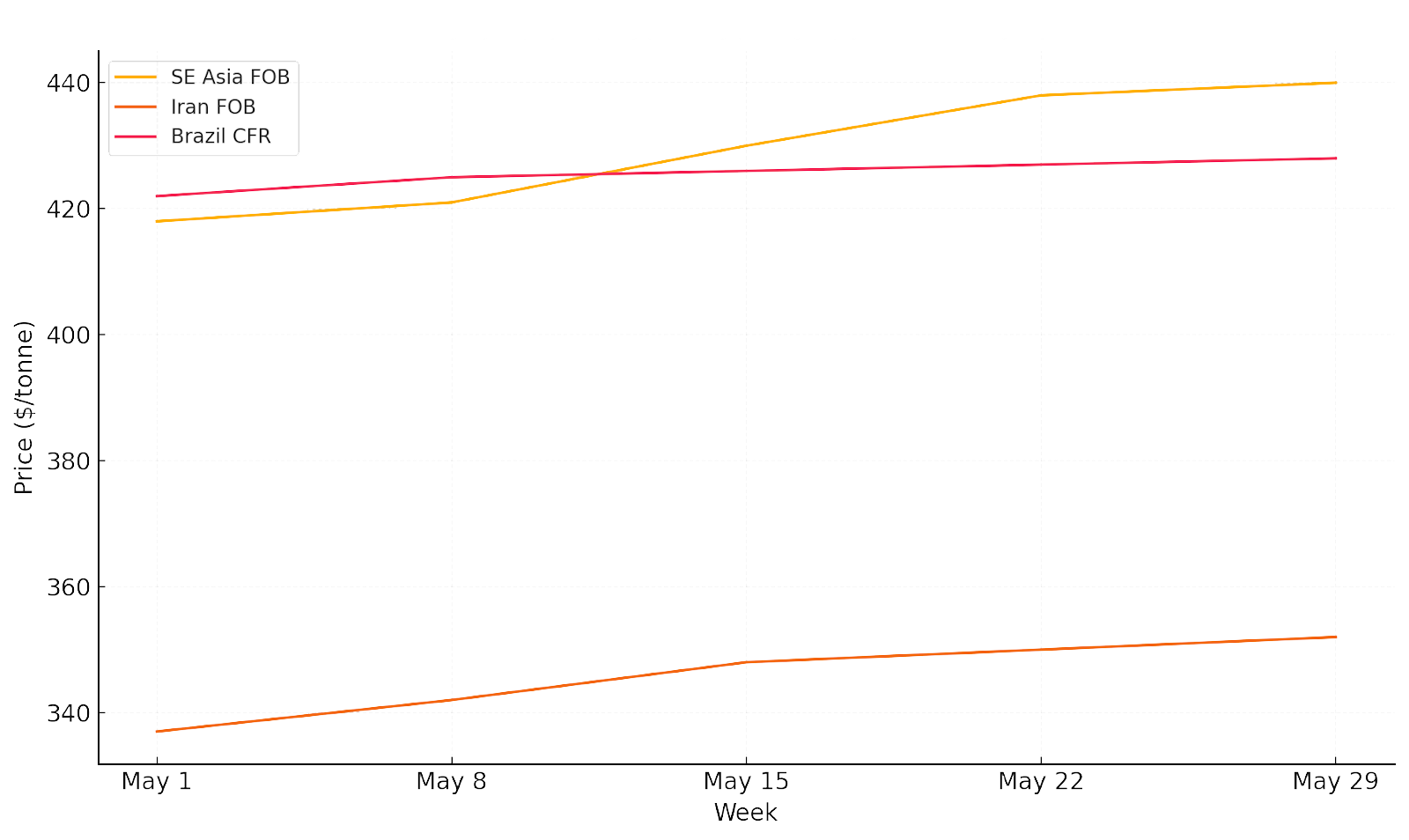

- SE Asia FOB prices rose from 418 USD/MT to 440 USD/MT due to tightening Chinese quotas and improved demand.

- Iran FOB prices recovered from 337 USD/MT to 352 USD/MT as production resumed despite export disruption at Bandar Abbas.

- Brazil CFR held steady, rising slightly from 422 USD/MT to 428 USD/MT, with buyers cautious amid global uncertainty.

Granular Urea Price Trends - May 2025

Granular Urea Price Trends

Weekly average FOB and CFR prices from SE Asia, Iran, and Brazil.

2. Key Fertilizer Benchmarks – (USD/MT)

| Product | Early May | Late May | Change | Trend |

|---|---|---|---|---|

| Granular Urea (FOB Iran) | 337 USD | 352 USD | +15 USD | ⬆️ Firming |

| Prilled Urea (FOB Iran) | 330 USD | 340 USD | +10 USD | ⬆️ Steady |

| DAP (CFR India) | 635 USD | 645 USD | +10 USD | ⬆️ Bullish |

| MAP (CFR Brazil) | 530 USD | 540 USD | +10 USD | ⬆️ Firm |

| Sulfur (FOB Iran) | 140 USD | 150 USD | +10 USD | ⬆️ Rising |

| Ammonia (FOB ME) | 315 USD | 310 USD | -5 USD | ⬇️ Softening |

*ME: Middle East

3. Regional Trade Highlights

- China: Export quota (3.5–4M tons) started 6 May; inspections slowed first shipments. Strong domestic prices for DAP and urea.

- Iran: Stable output and pricing; May export loss estimated at 50–150kt due to the Bandar Abbas incident.

- India: Delayed urea tender created uncertainty. DAP imports increased.

- Africa: Demand remained strong for granular urea and NPK; Lome, Abidjan, and Mombasa ports reported high fertilizer activity.

- Brazil & LATAM: Moderate urea demand; NPK blending remained active. MAP saw marginal gains.

4. Freight & Logistics

- Port congestion is reported in Chinese terminals and Lome, affecting inspection times and vessel discharge rates.

- Freight rates increased 5–8% MoM for Supramax shipments, especially to Africa and SE Asia.

- Impact: Slight uptick in CIF-based offers globally, especially for bulk urea and DAP.

Summary Snapshot

| Market Driver | Impact | Notes |

|---|---|---|

| China Export Resumption | ⬆️ Supply | But with delayed execution due to inspections |

| Iran Production | ⬆️ Supply | Output normalized; export bottlenecks remained |

| India Tender Delay | ⬇️ Sentiment | Global urea buyers cautious; bullish June outlook |

| African Demand | ⬆️ Demand | NPK and granular urea remained in strong demand |

| Logistics | ⬆️ Cost | Congestion and freight tightening across key routes |

Granular and Prilled Urea Market

Market Dynamics and Strategic Context

In May 2025, granular urea continued to dominate global nitrogen trade, both in volume and market influence. Its pricing behavior over the month reveals how the interplay of production recovery, regulatory controls, and logistical disruptions shaped trends.

Following China’s export reactivation on May 6, market participants expected FOB values to correct downward. However, bureaucratic bottlenecks and strict MOFCOM approval procedures delayed most actual loadings until late May, resulting in a counterintuitive price surge in Southeast Asia, where FOB prices rose from 418–421 USD/MT to 438–440 USD/MT.

Meanwhile, exporters in the Persian Gulf — a central urea-supplying corridor — regained production momentum after early-year disruptions. By mid-May, plants across the region (including terminals feeding Africa, Turkey, and Latin America) executed confirmed tenders at increasingly firm prices.

At the beginning of May, FOB offers ranged around 337 USD/MT, rising to 345–350 USD/MT mid-month and closing near 352 USD/MT in final-week trades. This movement was further amplified by temporary container shipment disruptions at a key Persian Gulf terminal, which removed up to 150,000 MT of expected exports during a critical trade window.

Demand remained solid across all key importing regions:

- Africa saw a spike in seasonal procurement, particularly through Lome and Abidjan.

- Brazilian buyers maintained cautious interest, constrained by domestic inventory but still active.

- Turkey and South Asia favored granular and prilled forms depending on the demand for blended grades.

Weekly Price Comparison Chart

Weekly granular urea price trends in May 2025 for four regions — Persian Gulf (FOB), SE Asia (FOB), Brazil (CFR), and Africa (CFR). The visual highlights synchronized price strength, driven by global tendering activity and supply-side delays.

Price Trend Table (USD/MT)

| Week | FOB Persian Gulf | FOB SE Asia | CFR Brazil | CFR Africa |

|---|---|---|---|---|

| May 1 | 337 | 418 | 422 | 465 |

| May 8 | 342 | 421 | 425 | 467 |

| May 15 | 348 | 430 | 426 | 468 |

| May 22 | 350 | 438 | 427 | 471 |

| May 29 | 352 | 440 | 428 | 475 |

Analysis:

- SE Asia experienced a sharp rise due to delayed Chinese export flows.

- Persian Gulf FOB levels rose +15 USD over the month, driven by consistent bulk demand.

- CFR Brazil and Africa maintained upward pressure, reflecting steady logistics and active buyer engagement.

Bulk Export Tender Intelligence

| Port of Loading | Volume (MT) | Price (USD/MT FOB) | Buyer Region | Shipping Week | Notes |

|---|---|---|---|---|---|

| Persian Gulf (A) | 30,000 | 337 | SE Asia | May 1–5 | Early month spot cargo |

| Persian Gulf (B) | 30,000 | 345 | Latin America | May 15–20 | Contracted CIF cargo |

| Persian Gulf (C) | 60,000 (2 lots) | Mid-350s | West Africa | May 22–28 | Port congestion mitigated |

These transactions represent the core loadings influencing Persian Gulf FOB benchmarks during the month.

Prilled Urea Deep Dive

Prilled urea remained more stable and niche-oriented. Produced primarily for industrial applications and dry blends, it traded within a narrower band of 330–340 USD/MT FOB. Buyers from Turkey, West Africa, and Southeast Asia remained active, favoring:

- Smaller packaging and better granulation control

- Cost-effective port discharge (especially at smaller terminals)

- Short-term spot contracts with summer shipment windows

| Product Form | First Name | Last Name | Email Address |

|---|---|---|---|

| Prilled Urea | 330 | 340 | +10 |

| Granular Urea | 337 | 352 | +15 |

Prilled urea’s value lies in its logistical efficiency and blending consistency, making it particularly suitable for markets like Turkey, where internal transport costs and warehouse packaging matter more than bulk maritime savings.

Market Outlook

With the anticipated MMTC tender from India expected in the first half of June, price pressure is likely to build, especially in the FOB Persian Gulf and SE Asia markets. Sellers are expected to hold firm on pricing due to:

Strong demand from Africa, India, and Turkey

Reduced available tonnage following May disruptions

High freight and insurance premiums across key delivery routes

Strategic buyers are securing June-July shipments early to hedge against further tightening and rising prices.

Ammonia Market

Global Market Overview

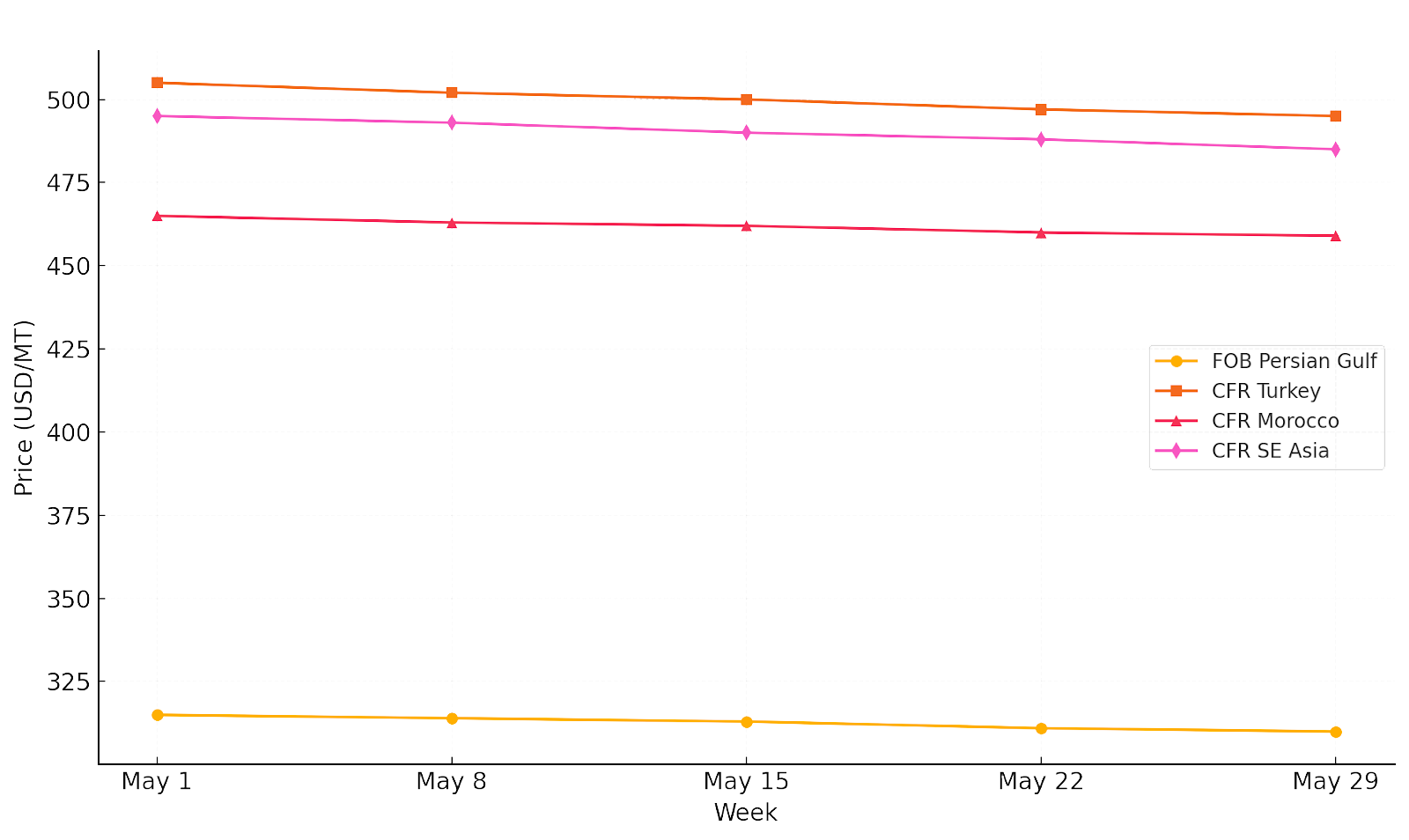

The ammonia market entered May 2025 structurally oversupplied. Producers in the Persian Gulf operated at high capacity, and demand from Asia and North Africa was underwhelming. Throughout the month, prices declined steadily across all benchmarks.

FOB Persian Gulf ammonia prices dropped from 315 USD/MT at the start of May to 310 USD/MT by the end of the month. This decrease was driven by an accumulation of unsold volumes, especially from suppliers who had previously targeted India and Southeast Asia.

In the CFR Turkey market, values fell below 500 USD/MT, with end-of-month trades heard at 495 USD/MT and lower. Buyers remained inactive due to limited downstream demand and the availability of cheaper regional substitutes, such as ammonium sulfate and urea-ammonium nitrate.

One of the most influential benchmarks of the month was Trammo’s 25,000 MT delivery to OCP Morocco, reportedly sold at 459 USD/MT CFR. This deal influenced North African pricing and added bearish momentum in the western Mediterranean.

Southeast Asian prices softened in parallel, with CFR offers sliding from 495 to 485 USD/MT, partly due to the seasonal lull in industrial ammonia use and the delay in Indian urea procurement tenders (which often influence ammonia blending demand).

Ammonia Price Trend Chart

Weekly ammonia price trends by region. All major benchmarks — including FOB Persian Gulf and CFR destinations (Turkey, Morocco, SE Asia) — experienced steady declines.

Figure1: Weekly Ammonia Price Trends by Region - May 2025

Weekly Price Table – Ammonia (USD/MT)

| Week | FOB Persian Gulf | CFR Turkey | CFR Morocco | CFR SE Asia |

|---|---|---|---|---|

| May 1 | 315 | 505 | 465 | 495 |

| May 8 | 314 | 502 | 463 | 493 |

| May 15 | 313 | 500 | 462 | 490 |

| May 22 | 311 | 497 | 460 | 488 |

| May 29 | 310 | 495 | 459 | 485 |

Key Observations:

- All four price markers declined consistently through May.

- Persian Gulf FOB values showed limited resistance at the 310 USD/MT.

- The Morocco CFR deal became a critical reference point across North African tenders.

Key Market Deals

| Seller | Volume (MT) | Buyer | Delivery Terms | Price (USD/MT) | Region | Notes |

|---|---|---|---|---|---|---|

| Trammo | 25,000 | OCP Morocco | CFR | 459 | North Africa | Set a benchmark for Mediterranean sales |

| PG Exporter A | 20,000 | Turkish Blender | CFR | ~495 | Turkey | Discounted spot cargo |

| SEA Exporter | 10,000 | Vietnam | CFR | 485 | SE Asia | Pushed to market amid low demand |

Market Fundamentals

Supply Pressure

- High production rates in the Persian Gulf, North Africa, and the Black Sea exceeded short-term demand.

- Inventory levels at terminals were reportedly at 3-month highs by late May.

Demand Lull

- India remained absent from the urea/ammonia tender space.

- Lower methanol and nitric acid production weakened Southeast Asia’s industrial uptake.

- North African blenders slowed purchases and await better freight terms and gas market direction.

Maintenance Outlook

- Scheduled turnarounds in SE Asia (June–July) could help firm prices temporarily.

- Some European ammonia units are still offline due to energy cost exposure.

Outlook

| Market Factor | Expected Impact |

|---|---|

| SE Asia maintenance season | ⬆️ Temporary support |

| India's ammonia import delays | ⬇️ Continued softness |

| Gas price volatility | ⬇️/⬆️ Regional variation |

| Freight market pressure | ⬇️ FOB competitiveness |

Baseline Scenario: The global ammonia market will likely remain weak-to-stable in June, with FOB Persian Gulf possibly testing the 305 USD/MT floor unless regional outages accelerate spot interest.

Strategic buyers in Turkey, Morocco, and Indonesia may leverage the current weakness to lock in July/August deliveries at favorable CFR terms.

NPK Market

Market Overview

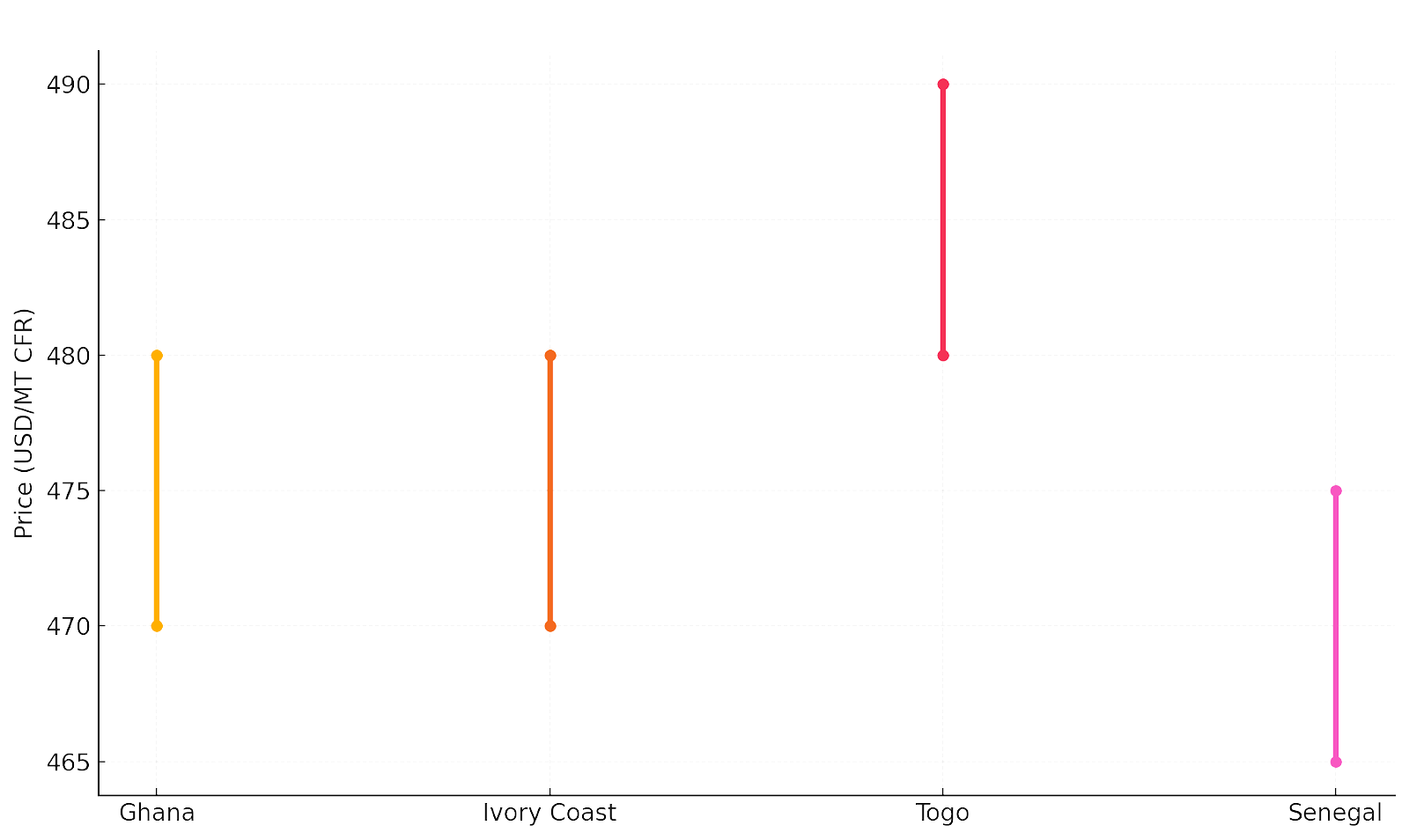

In May 2025, the global NPK (Nitrogen-Phosphorus-Potassium) market remained firm, with West Africa emerging as the primary hotspot for spot demand. Blenders and importers across Ghana, Ivory Coast, Togo, and Senegal continued booking large volumes of 15-15-15 and 20-10-10 blends to meet planting season requirements. Prices were supported by tight global availability, rising raw material costs, and freight volatility.

In contrast, India’s import activity slowed, with the FACT tender for 45,000 MT of 15-15-15 blend closing without result, indicating supplier hesitation due to regional prioritization and logistical constraints.

NPK CFR Price Range by Region

Figure1: NPK CFR Price Range by Region - May 2025

West Africa: Demand-Led Price Stability

- Ghana and Ivory Coast secured 15-15-15 at 470–480 USD/MT CFR, supported by ongoing planting activity and port readiness.

- Togo shifted slightly higher, booking 20-10-10 blends at 480–490 USD/MT CFR, driven by blend-specific demand and port congestion.

- Senegal also remained active, closing smaller contracts around

465–475 USD/MT CFR, reflecting a healthy yet price-sensitive market.

NPK shipments to Africa primarily originated from Russia, Morocco, and Tunisia, with producers opting for bulk contracts rather than fragmented tenders.

India: FACT Tender Cancelation Reflects Market Tightness

India’s Fertilisers and Chemicals Travancore Ltd (FACT) floated a spot tender for 45,000 MT of 15-15-15, yet it closed without any successful offer. The reasons include:

- Lack of competitive pricing compared to African contracts.

- Suppliers are prioritizing existing long-term deals in Africa and Southeast Asia.

- Global shipping costs are reducing arbitrage interest.

This marks the second consecutive month of failed Indian NPK procurement via tender—a trend that may pressure domestic inventories into Q3 2025.

Regional NPK Trade Summary

| Region | Blend | Blend | Max Price (USD/MT CFR) | Imported Volume (MT) | Trend |

|---|---|---|---|---|---|

| Ghana | 15-15-15 | 470 | 480 | 30,000 | Stable |

| Ivory Coast | 15-15-15 | 470 | 480 | 25,000 | Stable |

| Togo | 20-10-10 | 480 | 490 | 28,000 | Slightly Firm |

| Senegal | 15-15-15 | 465 | 475 | 15,000 | Slightly Firm |

| India (FACT Tender) | 15-15-15 | - | - | 45,000 (tendered) | Tender Failed |

Outlook for June 2025

- Due to continued seasonal usage, African markets are expected to remain firm, particularly in ports like Lomé, Tema, and Abidjan.

- India may revise tender terms or offer pricing incentives to attract new volumes.

- Blending activity in Latin America and Southeast Asia could increase raw material prices, sustaining high global CFR values.

Key Insights

| Factor | Impact |

|---|---|

| Raw material tightness | Elevated production cost across all blends |

| African seasonality | Consistent import demand, especially 15-15-15 |

| Indian spot market failure | Indicates redirection of supply to the African region |

| Supplier preferences | Favor long-term deals over risky spot tenders |

| Freight rates | Sustained pressure on the CFR-based offers |

Regional Market Highlights

Africa: Sustained Demand and Port Congestion

The African fertilizer market remained highly active throughout May 2025. Both West and East Africa increased imports of granular urea and NPK blends. Major import destinations included:

- Ghana

- Ivory Coast

- Nigeria

- Kenya

Port Line-Up Insights:

- Port of Lomé: Received multiple bulk shipments of granular urea and 15-15-15 blends.

Port of Abidjan: Experienced vessel queuing, with delays averaging

1,000–2,000 MT/day due to congestion and weather-related slowdowns.

Key NPK and Urea Deliveries to West Africa

| Country | Main Ports | Product | CFR Price (USD/MT) | Estimated Volume (MT) |

|---|---|---|---|---|

| Ghana | Tema | Urea 46% | 470–475 | 30,000 |

| Ivory Coast | Abidjan | NPK 15-15-15 | 480–490 | 25,000 |

| Nigeria | Lagos, Apapa | Granular Urea | 468–472 | 32,000 |

| Togo | Lomé | NPK 20-10-10 | 480–490 | 18,000 |

India: Quiet Urea Market, Active DAP Procurement

India remained a critical market influencer, but notably did not announce a urea tender in May, creating global price uncertainty.

- DAP imports surged, with CFR values hitting 640–645 USD/MT.

- FACT’s tender for 45,000 MT of NPK 15-15-15 closed without allocation, suggesting:

- Tight global NPK supply

- Prioritization of long-term contracts by Russian/Moroccan suppliers

- High global pricing environment

China: Quota-Based Resumption and Bottlenecks

China resumed exports of urea and phosphate fertilizers under a strict quota of 3.5–4 million MT starting May 6, 2025. However:

- Customs inspections delayed actual loadings until late May.

- CFR values remained firm across DAP and urea markets due to slow execution.

Export Execution Bottlenecks:

- Average delay: 7–10 days post-loading window

- SE Asia buyers turned to the Middle East & Africa for quicker supply

Brazil: Stable Demand, Limited Spot Activity

Brazilian traders adopted a measured buying approach in May:

- Granular urea CFR prices stayed between 420–428 USD/MT

- MAP demand was steady at 530–540 USD/MT CFR

- Potash activity paused, awaiting contract renegotiations for H2 2025

Brazilian CFR Urea Price Stability

| Week | CFR Price (USD/MT) |

|---|---|

| Early May | 422–425 |

| Mid May | 426–427 |

| Late May | 428 |

Middle East / Persian Gulf: Consistent Supply Despite Disruption

- Iran maintained operations with key producers like Pardis, MIS, and Lordegan.

- FOB prices for granular urea ranged 337–352 USD/MT.

- Prilled urea was stable at

330–340 USD/MT, with strong interest from Turkey and Asia.

The Bandar Abbas explosion (early May) significantly reduced containerized export capacity by an estimated 50,000–150,000 MT, but bulk shipments from Bandar Imam and Assaluyeh remained unaffected.

Freight and Logistics

Global Freight Market Overview

May 2025 witnessed a notable tightening in the global freight and maritime logistics environment, driven by:

- Seasonal congestion at key ports in West Africa and Southeast Asia

- Reduced vessel availability due to high chartering demand

- Post-quota export surges from China and Iran, overwhelming port operations

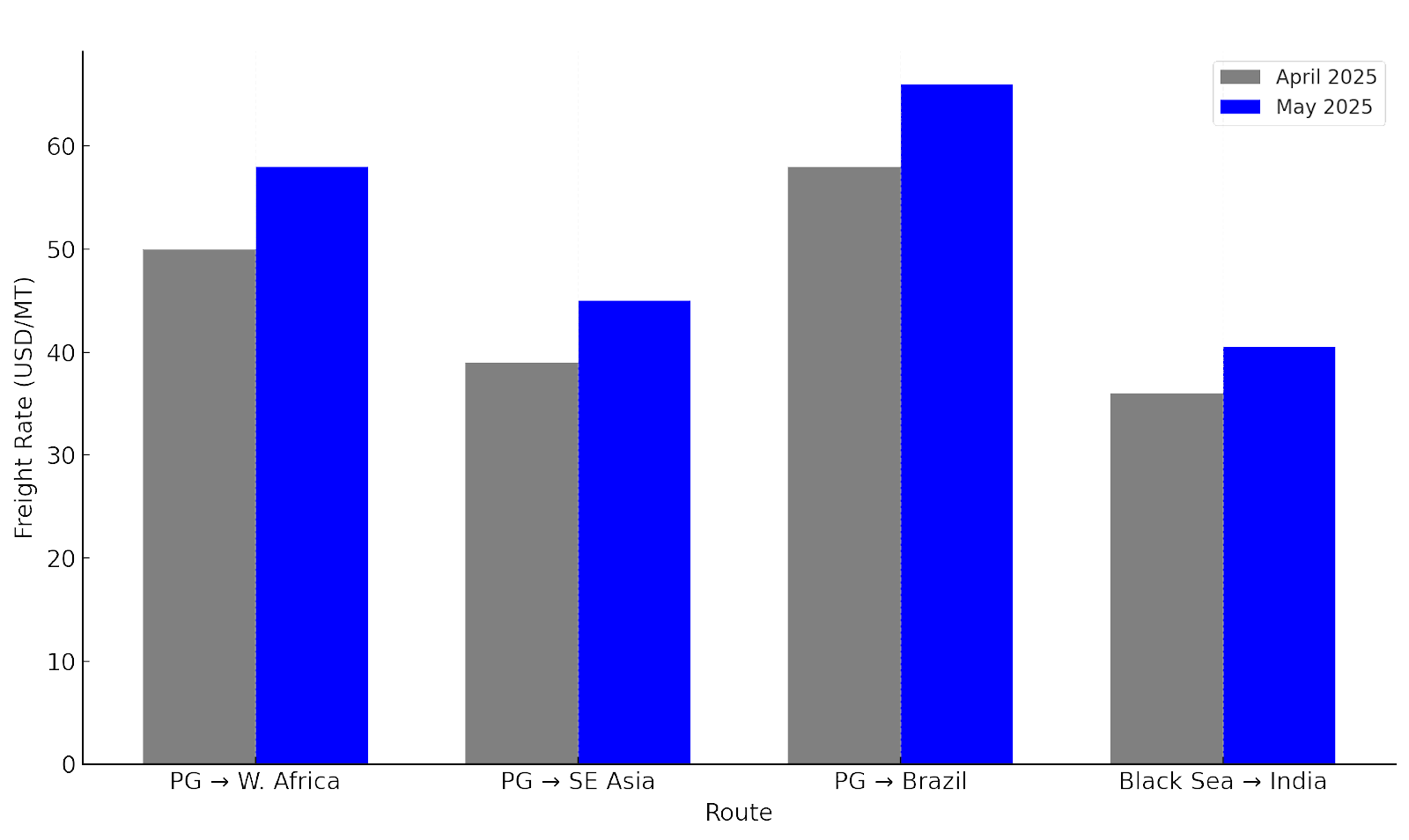

The effects were felt across all major dry bulk segments, especially in Supramax and Handysize classes used for fertilizer and petrochemical shipments. This resulted in 5–8% month-on-month freight rate increases, complicating CFR negotiations and delivery scheduling.

Estimated Freight Rates – Key Routes

| Trade Route | Vessel Type | Early May (USD/MT) | Late May (USD/MT) | % Change |

|---|---|---|---|---|

| Persian Gulf → West Africa | Supramax | 54 | 58 | +7.4% |

| Persian Gulf → Southeast Asia | Supramax | 42 | 45 | +7.1% |

| Persian Gulf → Brazil (NE ports) | Handysize | 62 | 66 | +6.5% |

| Black Sea → India | Supramax | 38 | 40.5 | +6.6% |

| China (East Coast) → Philippines/Vietnam | Supramax | 30 | 33 | +10% |

Note: All figures are based on spot market indications and trade line-up data sourced from the uploaded documents.

Regional Logistics Highlights

West Africa (Lomé, Abidjan, Lagos)

- High vessel traffic and limited berth availability created significant queuing at all major West African ports.

- Discharge rates fluctuated between 1,000 and 2,000 MT/day, often lower in adverse weather.

- Extended demurrage costs were reported, especially for delayed containerized and bagged shipments.

China – Post-Quota Congestion

- Following the resumption of fertilizer exports on May 6, Chinese ports (Qingdao, Tianjin, Fangcheng) experienced intense export traffic.

- Customs inspections and export certificate processes delay shipments by

7–10 days, especially for DAP and granular urea.

Persian Gulf – Bulk Export Resilience

- Despite the Bandar Abbas explosion, bulk fertilizer exports from Bandar Imam and Assaluyeh remained steady.

- Iranian producers prioritized shipments to:

- Brazil (NE coast)

- West Africa (Lomé, Abidjan)

- Southeast Asia (Malaysia, Philippines, Thailand)

50,000–150,000 MT reduced containerized shipments from Bandar Abbas in May, but bulk trade remained largely uninterrupted.

Outlook for June 2025

The global fertilizer and petrochemical markets are set to enter June 2025 with a cautiously bullish tone, shaped by several demand-side and logistical developments. Key market drivers include the anticipated Indian MMTC urea tender, persistent delays in Chinese fertilizer exports, and constrained sulfur and DAP supply from the Middle East and East Asia. Freight markets are also expected to exert continued pressure on CFR values globally.

Freight Rate Trends – Supramax Segment

(April vs. May 2025)

Figure 1: Freight Rate Trends - Supermax Segment (April vs. May 2025)

Key Segment Forecasts:

| Segment | Outlook | Drivers |

|---|---|---|

| Granular Urea | ⬆️ Bullish | Expected MMTC tender in India; slower export flows from China; tight regional inventories. |

| Prilled Urea | ⬆️ Steady to Firm | Moderate buying interest from Southeast Asia and Turkey; stable Iranian supply. |

| DAP/MAP | ⬆️ Firm | India and Africa remain active importers; Chinese export caps keep prices elevated. |

| Ammonia | ➡️ Flat to Soft | Asian industrial demand remains sluggish; there is a surplus in the Persian Gulf. |

| Sulfur | ⬆️ Bullish (East Asia) | East Asian demand is expected to rise, Chinese inventories are tightening, and Persian Gulf FOB offers are rising. |

| Freight | ⬆️ Upward Pressure | Congestion at West African and Chinese ports; limited Supramax availability. |

Regional Drivers to Watch:

- India: A large urea tender in early June could realign FOB and CFR markets.

- China: Export inspections continue to slow post-May six quota resumption; June shipments may shift to July.

- Africa: Fertilizer arrival delays and increasing food security programs will sustain demand.

- Regional maintenance and shipping constraints will impact the Persian Gulf: Sulfur and ammonia markets.

June is poised to be a transition month, where slow-moving fundamentals from May may gain momentum across urea, phosphate, and sulfur markets. The freight segment, in particular, will likely shape pricing and delivery timelines more aggressively than in prior months.

Conclusion – May 2025 Fertilizer & Petrochemical Market Report

May 2025 was a pivotal month for global fertilizer and petrochemical markets, marked by shifting trade dynamics, tightening freight conditions, and regional supply-demand imbalances across urea, phosphates, NPKs, sulfur, and ammonia.

Key Takeaways:

- Urea markets remained firm, particularly for granular urea, supported by limited Chinese export volumes, resurgent Iranian supply, and expectations around India’s delayed tender. Prilled urea saw moderate price increases with stable operations from Persian Gulf producers.

- Phosphate markets, led by DAP and MAP, reflected strong CFR values, especially in India and Africa, while Chinese export restrictions tightened global availability and lifted prices.

- NPK complex fertilizers saw robust procurement across West Africa, with 15-15-15 and 20-10-10 blends booked at high CFR values. Indian tenders remained unfulfilled, underscoring ongoing supply tightness.

- East Asia's sulfur and sulfuric acid prices were bullish due to low inventories and strong demand, especially in China. Persian Gulf rose in response.

- Ammonia prices trended downward globally, pressured by oversupply and tepid industrial demand. Hopes were pinned on summer maintenance turnarounds to tighten the market.

- Freight markets added cost pressures across all segments, with Supramax rates climbing 5–8% Month over Month. Congestion at

West African ports and Chinese terminals impacted delivery schedules and FOB-to-CFR conversions.

Strategic Implications for June:

As we enter June, price volatility and logistical complexity will remain dominant themes. The global market awaits India’s MMTC urea tender, potential changes in Chinese export enforcement, and a clearer signal from African buying programs. Market participants should prepare for continued freight tightness and possible bullish shifts in nitrogen and sulfur segments.

Green Gubre Group remains committed to delivering real-time insights and dependable sourcing solutions for fertilizers, petrochemicals, metals, and alloys.

References

- Argus Media – Fertilizer Market Reports

- Profercy – Nitrogen Weekly Reports & Forecasts

- ICIS – Fertilizers Prices, Analytics & Forecasts

- CRU International – Global Fertilizer Intelligence

- S&P Global Commodity Insights – Fertilizers Market Data

- India MMTC – Fertilizer Tender Announcements

- Iran Line-Up Data – Argus Reports | Profercy Reports