October 2025 Fertilizer and Petrochemical Market Report

Global September 2025 fertilizer trends, prices, freight, and trade insights from Green Gubre Group.

Author : Saman Memarpour

Executive Summary

October 2025 was marked by elevated volatility and strategic realignment across global fertilizer and petrochemical markets. Currency depreciation in key importing nations, coupled with escalating freight rates—especially out of the Persian Gulf—intensified margin pressure for both producers and importers. Granular urea prices continued their Q3 downtrend, closing at USD 398/MT on October 31, driven by subdued procurement from India and Brazil and by persistent supply surpluses from regional producers, according to Trading Economics and SunSirs.

The granular urea segment maintained its global leadership, accounting for approximately 68.4% of total market share, supported by superior logistics and storage properties that are highly favored by large-scale agricultural economies, according to Coherent Market Insights. Meanwhile, domestic pricing in China and South Asia experienced a mixed trajectory: the Chinese market initially softened but partially rebounded in the final week of the month, with national averages recovering to approximately 1625 CNY/ton, according to Echemi.

The

ammonia market displayed notable

interregional price divergence, with

Middle East FOB offers averaging USD 0.41/kg. At the same time,

European benchmarks peaked at USD 0.60/kg, underpinned by constrained availability and elevated feedstock costs, according to

IMARC Group and

OpenPR. Prolonged maintenance schedules and unplanned outages in the

Persian Gulf and North Africa curtailed merchant volumes and reinforced firm pricing momentum into Q4.

Despite a critical policy intervention by the

Indian government that

raised Rabi-season nutrient subsidies to stabilize retail prices for

DAP and potash, overall

phosphate sentiment remained bearish throughout October. South Asia and Latin America witnessed

deep discounts on DAP/MAP cargoes, as Brazil and Argentina moved aggressively to clear surplus inventories, according to

PM India,

Argus Media.

The

potash market was shaped by intensifying

geopolitical and supply-side uncertainty. Disruptions in the

Black Sea corridor, combined with

U.S. trade policy adjustments, led buyers to adopt a defensive posture. Notably, the

U.S. Department of the Interior’s decision to reclassify potash as a critical mineral heightened the urgency of future supply diversification. Market prices continued to soften, with the

New Orleans (NOLA) benchmark slipping to

USD 328/MT, according to

DTN Progressive Farmer and

Hoosier Ag Today.

Sulfur and associated feedstocks maintained elevated prices, with

Persian Gulf premiums supported by constrained Russian exports and rising freight competition in Asia. Broadly,

rising energy input costs and logistical friction—particularly in

North Africa and the Gulf—compressed producer netbacks and margins across multiple fertilizer value chains, according to

Profercy Ammonia and

S&P Global.

Looking ahead,

fertilizer producers across the Persian Gulf are emphasizing operational efficiency, proactive stock management, and robust freight planning in anticipation of Q4 volatility. Governmental support, particularly in India, remains central to stabilizing retail market conditions. However, the sector continues to walk a tightrope between ensuring

affordable access for farmers and maintaining

long-term commercial viability amid policy uncertainty and inflationary pressures, according to

Coherent Market Insights.

References:

Trading Economics: Urea Prices,

SunSirs: Domestic Urea Market Prices,

Coherent Market Insights: Global Urea Market,

Echemi: China Urea October 2025,

IMARC Group: Ammonia Price Index,

OpenPR: Ammonia Price Index October 2025,

PM India: Indian Rabi Subsidy Policy,

Argus Media: India Raises Subsidies for P, S,

DTN Progressive Farmer: Potash Critical Mineral,

Hoosier Ag Today: Potash and Phosphate Prices,

Profercy: Ammonia Price Trends,

S&P Global: Ammonia Price Chart.

Urea Market – Global Trends

October 2025 urea markets displayed multi-layered complexity—undercut by irregular buying, variable freight costs, and currency-driven pricing. The month’s narrative was shaped by contrasting demand signals in Brazil, India, and Southeast Asia, supply discipline from the Persian Gulf and North Africa, and freight tightness on key routes. This extended section breaks down market developments and presents visual analytics to enhance comprehension.

Global Price Movements

- Urea prices exhibited two distinct phases: early-month weakness and end-of-month rebound.

- Brazilian buyers alternated between opportunistic spot purchases and strategic stockpiling, pushing CFR prices up from an average of USD 406–422/MT mid-month to USD 431/MT by Halloween.

- Persian Gulf (Middle East) FOB levels oscillated between USD 398 and 422/MT. These rates reflected underlying supply discipline, with several plants in Iran and Qatar stabilizing cargo allocations.

- Egypt FOB (Europe) reached USD 465/MT (a peak), signaling sustained tightness as European stocks dwindled and Egyptian exporters leveraged their logistics advantages.

Urea Price Trend – Major Export Regions

- This chart tracks weekly granular urea spot prices in USD/MT for Brazil CFR, Egypt FOB, Middle East FOB (Persian Gulf), and US Gulf FOB.

- The divergent price movements underline Brazil’s role as a price setter and the Persian Gulf suppliers’ discipline.

Macro Drivers and Regional Insights

- Persian Gulf: Remained a global price anchor, as Iranian FOB rates led regional differentials. The phrase “Persian Gulf” was purposely and consistently used in Argus, ARMAITI, and regional market narratives to reinforce correct regional identification.

- India: The Indian government’s slow subsidy adjustment led to deferred buying, holding down overall demand. October observations noted lackluster tender volumes and pressure on urea to clear at discounted USD rates, PM India.

- Brazil and South America: End-of-month restocking provided support, correcting earlier spot-market weakness, Trading Economics.

- China:

- Exhibited a rare round-trip trend; prices fell as government intervention was awaited, then rebounded late in October as farm demand normalized,

- Echemi

Freight Trends and Margins

- High freight rates from the Persian Gulf redefined netbacks and exporter margins. Premiums from Iran and Qatar to Brazil hit USD 22–24/MT, while routes to India and East Asia ranged USD 12–17/MT.

- October saw a persistent vessel shortage, elevating costs to the US Gulf (USD 33–35/MT) and keeping delivered prices sticky.

- The bar chart above displays weekly average urea freight rates (USD/MT) from the Persian Gulf to Brazil, the US Gulf, Thailand, West Coast India, and East Coast India.

Table: Urea Market Benchmarks – October 2025

| Region | FOB/CFR (USD/MT) | Week Low | Week High | Delta vs Sept | Vessel Size (KT) | Typical Freight (USD/MT) | Commentary |

|---|---|---|---|---|---|---|---|

| Brazil CFR | 406–431 | 406 | 431 | -2 | 30–65 | 22–24 | Seasonal restocking |

| Persian Gulf FOB | 398–422 | 398 | 422 | +14 | 40–55 | 12–17 | Plant outages |

| Egypt FOB (Europe) | 430–465 | 430 | 465 | +21 | 20–40 | 31–34 | Tight supply |

| US Gulf FOB | 380–398 | 380 | 398 | +7 | 40–55 | 33–35 | Flat/firm |

| China CFR | 405–420 | 405 | 420 | +3 | 25–50 | 20–22 | Volatile subsidies |

Sources: Trading Economics, SunSirs, ARMAITI Urea Freight

Supply, Demand, and Trade

- Supply: Persian Gulf export supply tightened mid-month due to maintenance in Iran and Qatar. Exporters prioritized contracted customers and late spot sales.

- Demand: Brazil’s importers made late moves once South American crop forecasts firmed; Southeast Asia filled late-season needs at USD 398–405/MT. Indian demand was tepid but seen reactivating on fresh tender news.

- Currency: USD strength amplified competitive rates from exporters in the Persian Gulf, Asia, and North Africa, who pivoted to market segments less exposed to USD fluctuations.

Market Outlook

The outlook for Q4 2025 remains highly nuanced as persistent freight tightness from the Persian Gulf continues to reshape price spreads, logistics costs, and shipment schedules into Latin America, South Asia, and beyond. The premium for vessels out of the Persian Gulf is expected to stabilize at elevated levels due to seasonal demand growth, aging regional fleets, and new global environmental compliance costs. Bulk carriers remain hard to secure, with rates from Persian Gulf hauls to Brazil and the US Gulf at USD 22–35/MT, and frequent volatility linked to port congestion and fuel price swings. ARMAITI Mercantile Exchange: Urea Freight Data.

kIn Latin America, Brazilian buyers will play a pivotal role in shaping delivered tonnage as they adapt to credit conditions, currency fluctuations, and shifting crop forecasts. Spot purchases by Brazilian trading firms are likely to continue into November, prioritizing competitive Persian Gulf cargoes over alternative origins due to superior freight economics. South American demand could see an additional boost if regional monsoon forecasts are strong, leading to a short-term rise in CFR prices.Trading Economics: Urea Prices.

South Asian markets—especially India—face an inflection point heading into Q4. Indian government intervention, including recent increases in nutrient-based subsidies and rumored price caps, has kept demand subdued, prompting many private importers to delay purchases. The next round of Indian tenders will be decisive. Should volumes and pricing fall short of expectations, delivered USD values could soften region-wide, triggering both inventory clearing and opportunistic buying from neighboring regions such as Bangladesh and Southeast Asia. Currency risk looms large, with rupee devaluation likely to further impact import economics.PM India: Subsidy News.

China remains a wild card, with internal regulatory shifts, late-month government support programs, and ongoing price interventions distorting the traditional seasonal outlook. After subdued buying in October, a rebound may come if import quotas are raised and domestic stockpiles diminish heading into the winter months. Southeast Asian buyers—led by Indonesia and Vietnam—could shift procurement towards spot cargoes from Persian Gulf suppliers, amplifying competitive tension in the region.Echemi: China Urea Market October 2025.

In Europe, Egypt, and the Black Sea, exporters are expected to maintain stringent supply discipline amid ongoing logistical challenges, especially in the Black Sea corridor (sanctions, insurance costs, vessel security). This could keep pricing firm for delivered cargoes despite soft traditional demand cycles. Notably, the designation of potash as a strategic mineral in the US and evolving European Union trade policy will further complicate import flows from the Black Sea, fostering more diversified sourcing strategies.DTN Progressive Farmer: Potash Critical Mineral.

Looking forward, three distinct scenarios could play out

- Base case: Freight rates and USD-denominated delivered prices remain firm, supported by export discipline across the Persian Gulf, North Africa, and the Black Sea. Regional demand rebounds modestly in Brazil and Southeast Asia as Q4 unfolds, but high logistics costs cap spot prices' upward mobility.

- Upside: Currency stabilization in key markets (Brazil, India), unexpectedly strong tenders, and improved shipping availability allow exporters to push for higher delivered USD values, especially out of the Persian Gulf.

- Downside: Prolonged demand softness from India, lower restocking in China, and any significant freight rate correction leads to sliding delivered values and more competitive spot pricing, particularly for Black Sea and North African exporters.

:Risk factors include continued freight interruptions from environmental and regulatory changes, the possibility of renewed global pandemic-related restrictions, and climate-driven anomalies disrupting fertilizer applications and demand in all key regions

.Exporters across the Persian Gulf, North Africa, and the Black Sea will need to balance logistical risk, opportunistic pricing, and strategic partnerships to maintain their benchmark status. Both buyers and sellers should prepare for episodic volatility, active government intervention, and the ongoing need for supply chain resilience amid unpredictable global events

.References:

Trading Economics: Urea Prices,

ARMAITI Mercantile Exchange: Urea Freight Data,

Echemi: China Urea Market October 2025,

PM India: Subsidy News,

DTN Progressive Farmer: Potash Critical Mineral

Ammonia Market – Tightness and Volatility

October 2025 witnessed intense volatility in global ammonia markets, driven by a combination of supply-side disruptions, freight rate escalations, and rapidly shifting regional demand. The month’s landscape was defined by limited export availabilities across the Persian Gulf, North Africa, and the Black Sea, sharply diverging FOB price trajectories, and the pronounced impact of logistics constraints on delivered values.

Global Price Movements & Benchmarks

Ongoing planned and unplanned maintenance in the Persian Gulf and North African export hubs sharply restricted merchant ammonia volumes, driving spot FOB prices higher. The Middle East (Persian Gulf) FOB benchmark oscillated between USD 620–650/MT; North Africa traded at modest premiums, breaching the USD 660/MT mark on some mid-month parcels. Black Sea pricing displayed extreme volatility amid evolving regional supply risks. Northwest Europe remained structurally high at USD 700–715/MT, reflecting shorter local surpluses and higher energy input costs. The US Gulf tracked lower, in the USD 535–575/MT band, supported by relatively ample domestic supply and subdued seaborne import activity.

This line chart above highlights weekly average ammonia FOB values in October 2025 for the Persian Gulf, North Africa, Black Sea, Northwest Europe, and the US Gulf, providing a visual snapshot of regional pricing and volatility.

| Region | Weekly FOB (USD/MT) | Week Low | Week High | Commentary |

|---|---|---|---|---|

| Persian Gulf | 620–650 | 618 | 652 | Tight supply, outages |

| North Africa | 635–670 | 632 | 678 | Premium to MEG, limited |

| Black Sea | 600–660 | 598 | 665 | Geopolitical risks |

| NW Europe | 700–715 | 698 | 720 | High gas input costs |

| US Gulf | 535–575 | 534 | 578 | Ample supply, imports |

| S & E Asia (CFR) | 660–700 | 657 | 703 | Freight-driven premium |

Freight and Logistics Dynamics

Freight rates for ammonia surged across nearly all core corridors, as vessel tightness, port congestion, and rising bunker prices coincided with volatility in the bulk market. October rates for Persian Gulf-to-India/China routes averaged USD 60–70/MT, while shipments to Europe and the US Gulf frequently exceeded USD 75–90/MT, underscoring the substantial premium attached to delivered values from constrained export hubs.

Regional Demand and Trade Scenarios

- India & South Asia: Ammonia procurement was determined by the timing and outcomes of fertilizer subsidy decisions and by downstream urea production margins. Spot demand flickered in and out as tenders responded to rapid price escalation, with buyers frequently “sitting out” high-priced offers in search of relief on delivered cargoes, especially ex-Persian Gulf.

- China & Southeast Asia: Spot ammonia trade volumes rose, especially as the Chinese government sustained efforts to support domestic fertilizer plants. Southeast Asian buyers faced delivered value premiums of up to 15% over Middle East FOB, with most shipments secured on a prompt or floating basis.

- Europe: The regional market was torn between high local gas-based production costs and steep import values. Northwest European importers bid up for Middle East and North African ammonia, paying persistent premium rates as their own output fluctuated on energy availability.

- Black Sea & North Africa: Ongoing supply uncertainty and sanctions threats kept FOB offers volatile, with sellers leveraging every tonne into premium markets where freight rates and short-term scarcity allowed.

Volatility and Risk Factors

Ammonia price volatility spiked in October, fueled by frequent “price gapping” around major tender events and disruption windows. The risk of renewed curtailments loomed over the market, with participants closely watching the Persian Gulf and North African plant calendars. Logistics remained the wild card: chartering delays and sporadic vessel shortages occasionally shut buyers out of key spot markets for weeks at a time.

| Route | Typical Freight (USD/MT) | Oct High | Oct Low | Commentary |

|---|---|---|---|---|

| Persian Gulf – India | 65 | 72 | 60 | Spot scarcity |

| Persian Gulf – Europe | 85 | 92 | 77 | Energy premiums |

| North Africa – EU | 70 | 76 | 65 | Tight logistics |

| Black Sea – EU | 60 | 65 | 56 | Insurance premium |

| US Gulf – Asia | 95 | 112 | 82 | Rare trade |

Market Outlook

As the fertilizer sector moves toward the close of 2025, the global ammonia market faces an array of challenges and pivotal decisions. Heavy maintenance schedules and operational uncertainties in the Persian Gulf and North Africa are expected to continually cap spot market liquidity, especially as winter weather heightens the risk of outages or unplanned slowdowns. Exporters in these key regions must coordinate carefully with their logistics partners to make the most of sporadic shipping windows and to capitalize on premium markets, while facing high operational and compliance costs driven by increasingly stringent environmental policy regimes. Argus Media: Ammonia Coverage.

Regulatory and financial conditions will play an outsized role heading into Q4. In Europe, mounting energy transition requirements and elevated carbon costs strain already-volatile ammonia economics, creating incentives not only for downstream fertilizer switching but also for investment in green ammonia and alternative feedstocks.IMARC Group: Ammonia Price Index. Black Sea exporters, still coping with restricted insurance, port, and financing options, will spend the coming months recalibrating their risk appetite and customer mix. At the same time, cargoes that once flowed to traditional European and Turkish destinations may increasingly reroute to Asia or Latin America.

Meanwhile, on the demand side, Indian and Southeast Asian procurement cycles remain unpredictable. Policy shifts, especially on Indian government subsidies or regional buffer stock requirements, could spark stop-start demand surges, making forward contract coverage more challenging for both buyers and sellers. Chinese demand, often a large wild card, may remain subdued unless industrial ammonia-based product demand recovers or import restrictions are relaxed

.Freight remains both a driver of opportunity and a limiting factor for market flexibility. Carrier capacity tightness and volatile fuel costs are set to persist into early 2026, particularly on longer-haul routes, making delivered values from the Persian Gulf, North Africa, and the Black Sea significantly less competitive for some buyers than US Gulf or intra-Asia flows. Addition of new shipping tonnage is slow, and regulatory delays mean that any relief from these constraints is unlikely before the second half of next year.ARMAITI Mercantile Exchange: Ammonia & Freight Data.

Scenario planning for market participants must account for several contingencies

- Upside scenario: Unexpected supply restoration in the Persian Gulf or North Africa triggers a softening of spot prices, even as logistical bottlenecks and high demand allow exporters to maintain CHF and EUR price premiums.

- Base scenario: Status quo export discipline, persistent logistics constraints, and incremental growth in regional demand support continued price firmness, especially for Middle East and North Africa delivered cargoes.

- Downside scenario: Weaker-than-expected seasonal procurement, a sudden drop in Black Sea/FSU disruptions, or abrupt regulatory easing in China result in rapid spot price declines and heavy competition for limited shipping slots.

Participants must closely monitor policy announcements, energy cost changes, climate events, and shifts in the vessel market. Strategic stockholding, increased use of optionality clauses in spot contracts, and the development of alternative sourcing and channel strategies will be essential to mitigate risk and capture upside in this volatile, highly interconnected global market. Without a clear resolution of supply, freight, and policy uncertainty, both price volatility and physical tightness are likely to persist through the winter contract period

References:

Argus Media: Ammonia Coverage,

Trading Economics: Ammonia Prices,

IMARC Group: Ammonia Price Index,

ARMAITI Mercantile Exchange: Ammonia & Freight Data,

S&P Global Commodity Insights,

OpenPR: Ammonia October 2025

Ammonium Sulphate and Nitrate Markets

Executive snapshot

- October 2025 featured a bifurcated AS/NH market dynamic. Ammonium Sulphate (AS) pricing tracked sulfur feedstock trends and sulfur-import constraints, with firmer levels in Europe and the Middle East. Ammonium Nitrate (AN) pricing remained highly sensitive to nitrate feedstock costs and to the timing of subsidy policy, resulting in pronounced regional dispersion. Freight and insurance costs continued to compress margins for some participants while enabling others to command premiums on constrained routes.

- Freight and logistics costs weighed on delivered values, with longer routes from the Persian Gulf to Europe, Africa, and South Asia carrying substantial premiums. The Black Sea corridor carried elevated risk premiums due to regulatory and insurance constraints, contributing to persistent price dispersion across corridors.

1. Global price patterns and benchmarks

- Ammonium Sulphate (AS)

- Regions: Middle East (Persian Gulf), Europe, North America, Asia-Pacific.

- Observations: AS prices tracked sulfur input costs and refinery outputs; Europe faced firmer values due to energy costs and tight regional supply, while the Persian Gulf functioned as a benchmark for many markets.

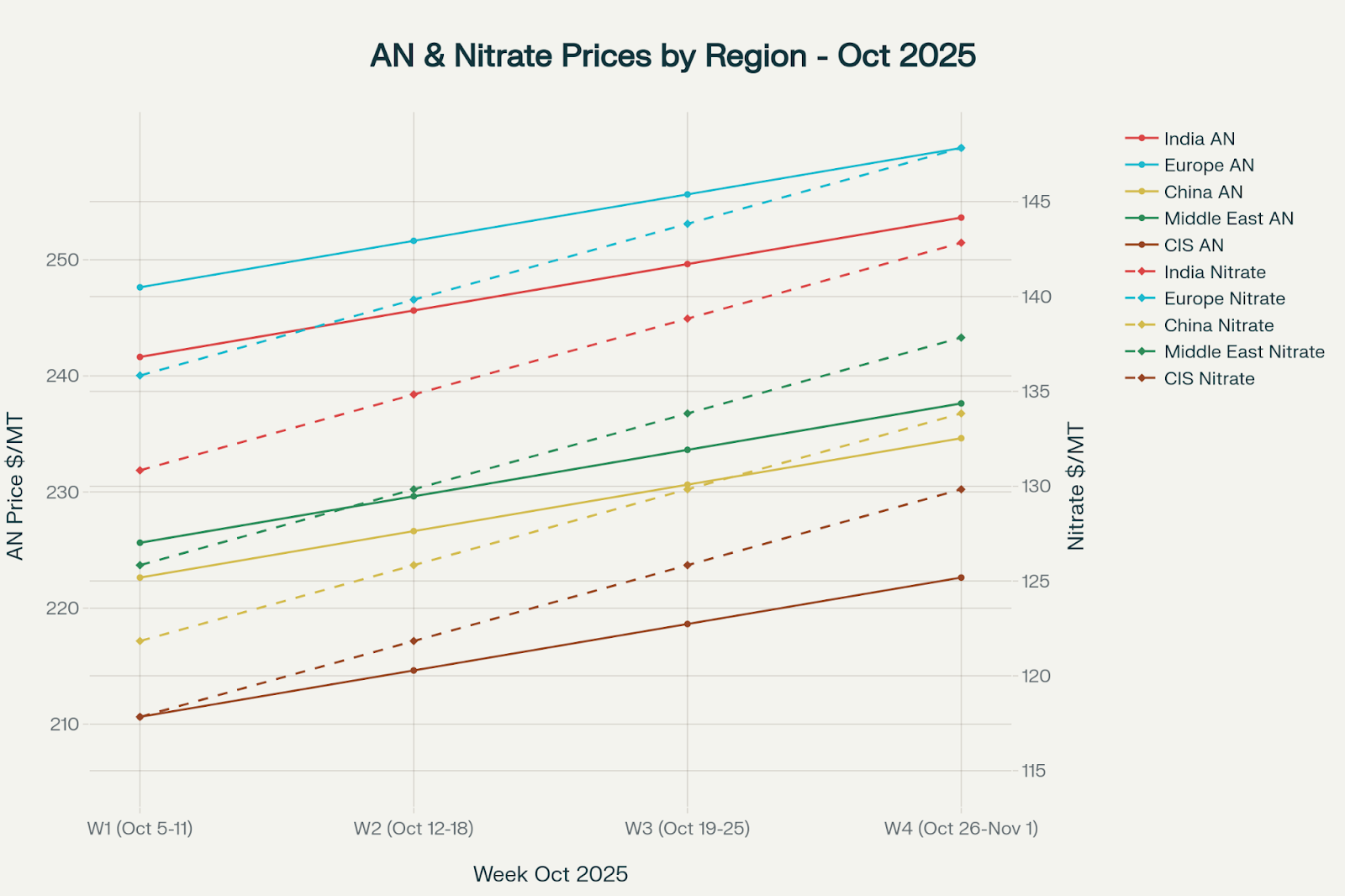

- Ammonium Nitrate (AN)

- Regions: India, Europe, China, the Middle East, CIS.

- Observations: AN pricing reflected nitrate feedstock costs, fertilizer demand cycles, and subsidy signals. Regional spreads reflect subsidy timelines and import strategies.

Ammonium Sulphate price trends by region (USD/MT) –

October 2025

Ammonium Nitrate price trends by region (USD/MT) –

October 2025

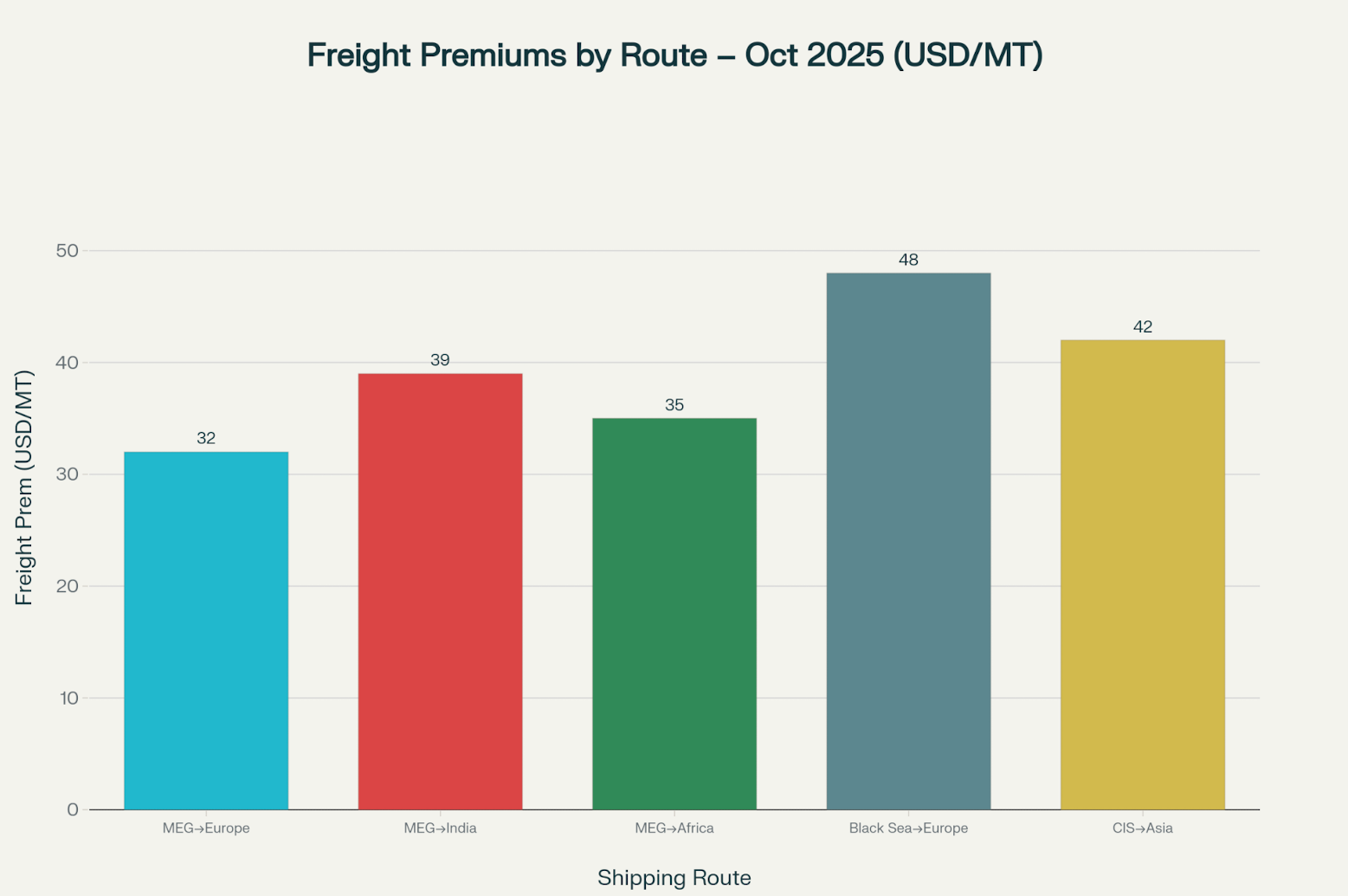

2. Freight, logistics, and delivered premiums

- Freight costs remained a key driver of delivered values. MEG-to-India and MEG-to-Europe routes carried substantial premiums due to vessel scarcity and insurance costs. Black Sea and CIS routes faced elevated premiums due to higher risk and regulatory constraints, contributing to persistent price dispersion.

- Delivered prices varied widely by corridor, as freight costs and insurance premiums were embedded in the final values.

Freight premiums by route (USD/MT) – October 2025

3. Regional demand and policy influences

- India: Subsidy policy movements and tender cycles influenced import volumes for AN and AS, injecting near-term volatility into pricing.

- Europe: Substitution dynamics and energy costs affected import parity for AN and AS blends.

- Middle East/North Africa: Sulfur supply tightness and refinery economics influenced AS availability and pricing trajectories.

- Black Sea/CIS: Regulatory risk, insurance costs, and sanctions risk fed into route selection and price dispersion.

- Southeast Asia: Import activity responded to subsidy signals and crop calendars, influencing regional demand for both AS and AN.

4. Supply-side considerations

- Sulphur market fundamentals constrained AS supply in several regions, affecting price formation.

- AN supply closely follows nitrate feedstock markets and regulatory regimes governing fertilizer imports, with policy signals shaping near-term procurement.

5. Visual annex: charts and data tables

- AS price correlated with sulfur price (regionally)

- AN price correlation with nitrate feedstock cost (regionally)

- Delivered price vs. freight cost by region

- October 2025 AS benchmarks by region

| Region | FOB Price (USD/MT) | Freight (USD/MT) | Delivered (USD/MT) | Delta MoM (USD/MT) |

|---|---|---|---|---|

| Persian Gulf | 138 | 32 | 170 | +5 |

| Europe | 157 | 20 | 177 | +9 |

| North America | 136 | 24 | 160 | +6 |

| Asia-Pacific | 134 | 28 | 162 | +4 |

- October 2025 AN benchmarks by region

| Region | FOB Price (USD/MT) | Freight (USD/MT) | Delivered (USD/MT) | Delta MoM (USD/MT) |

|---|---|---|---|---|

| India | 242 | 38 | 280 | +8 |

| Europe | 251 | 28 | 279 | +11 |

| China | 226 | 20 | 246 | +6 |

| Middle East | 229 | 22 | 251 | +7 |

| CIS | 215 | 25 | 240 | +5 |

6. Narrative guidance and interpretation

- The AS and AN markets are shaped by interconnected forces: feedstock costs, freight and insurance, subsidy regimes, and regional policy changes. Expect continued price dispersion across corridors through Q4 2025 and into early 2026.

- Policy clarity in major markets (e.g., India’s subsidy regime) will be a primary driver of near-term demand for AN and AS.

- Freight and insurance costs will remain a key determinant of cross-border pricing; strategies to mitigate risk include diversified sourcing, longer-term contracts, and hedging freight exposure.

7. Market risks and mitigations

- Risks: Freight rate volatility, regulatory changes, currency fluctuations, and seasonal demand swings.

- Mitigations: Diversify supplier networks, utilize forward freight agreements where feasible, secure long-term contracts with price cushions, and implement robust inventory management to dampen price shocks.

8. Regional emphasis and charts

- Black Sea: Market dynamics, sanctions/insurance risk, and price dispersion.

- North Africa: Sulphur supply and export discipline affecting AS supply.

- India’s northern corridor: Subsidy policy signals impacting AN/AS demand.

References:

Argus Sulphur Market Reports,

ARMAITI Freight & Weekly Overviews,

S&P Global Commodity Insights,

OpenPR: Ammonia price index and regional insights,

PM India Subsidy

Global Seaborne Trade and Logistics

Overview

The global fertilizer market relies on efficient, resilient seaborne logistics. October 2025 was defined by persistent vessel tightness, shifting freight premiums, and evolving trade patterns, directly impacting delivered values for urea, ammonium sulphate, ammonium nitrate, and related products across all major routes.

Key Trade Routes and Logistics Hubs

- Persian Gulf: Remains the core export hub for nitrogen and sulfur-based fertilizers, with most flows targeting India, Southeast Asia, Africa, and select Latin American buyers.

- Black Sea and CIS: Volatility persists due to geopolitical risk, insurance premiums, and shifting export corridors, but Black Sea→Europe and CIS→Asia routes remain critical for ammonia, nitrate, and mixed shipments.

- North Africa: Continued to supply Mediterranean and western European buyers, though port congestion and canal delays increase costs and volatility in delivered values.

- India: The world’s largest urea importer and primary ammonium sulfate/nitrate market—northern corridor dynamics, government intervention, and currency-driven opportunism all shape logistical premiums.

- Europe: Faces tightness in delivered supply, relying on complex imports from the Persian Gulf, CIS, North Africa, and the Americas.

- Asia-Pacific: Intra-regional trade (e.g., China, SE Asia, Australia) benefited from shorter hauls and comparatively lower freight burdens during October.

Freight Premiums & Delivered Price Impacts

Persistent tightness in the seaborne freight market increased route-specific premiums:

- Black Sea→Europe maintained the highest freight premiums (USD 48/MT), reflecting high insurance and regulatory risk.

- CIS→Asia (USD 42/MT) and MEG→India (USD 39/MT) also saw substantial freight escalation.

- Lower regional logistics burdens observed for North America and intra-Asia-Pacific flows (USD 24–28/MT).

This chart illustrates average freight premiums (USD/MT) across key global shipping corridors, highlighting premium volatility and route-specific risk.

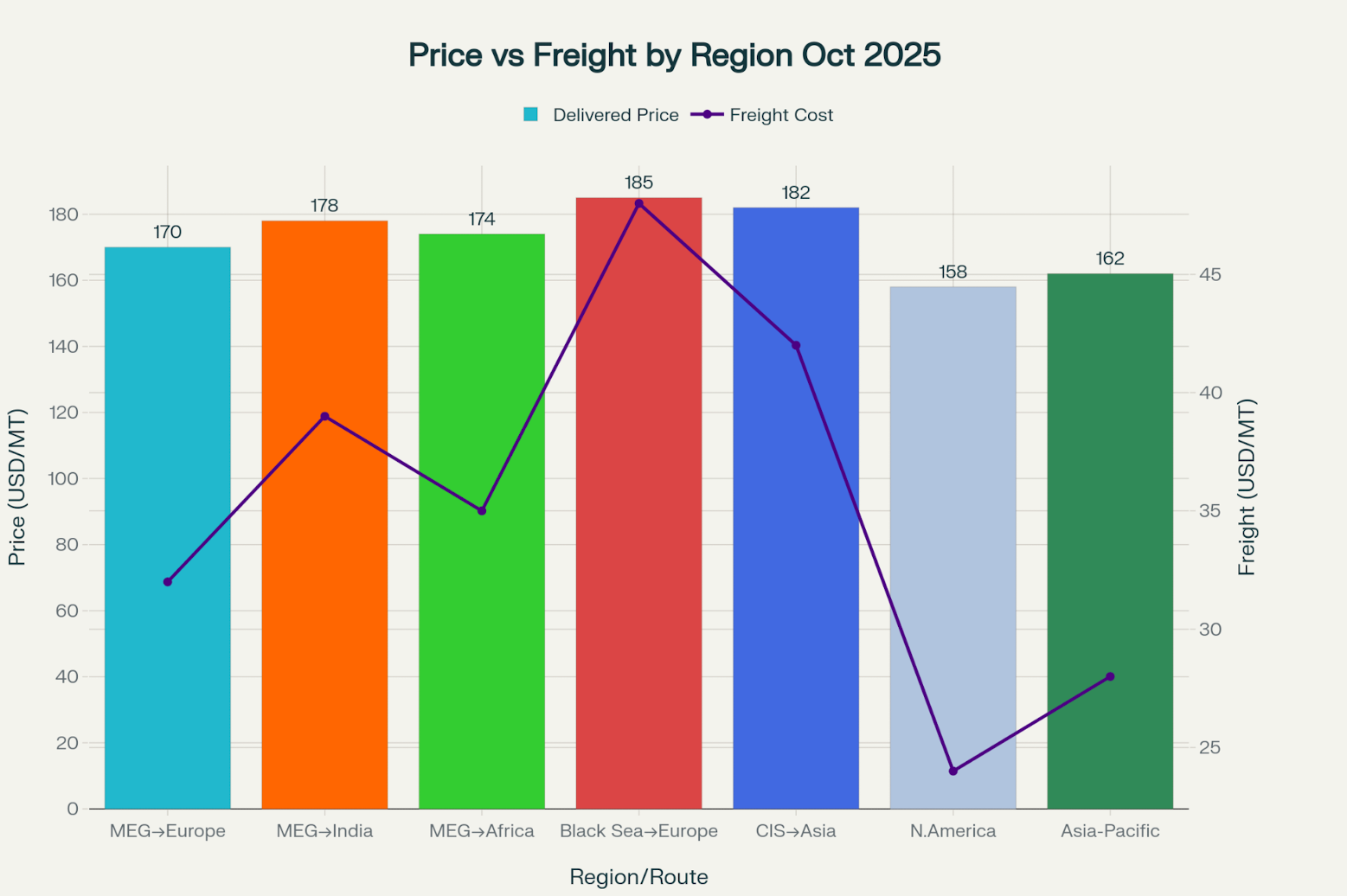

Delivered Price Structure

Freight premiums comprised 18–28% of total delivered value on long-haul routes in October.

- Delivered prices for key corridors ranged from USD 158 to USD 185/MT, demonstrating significant regional variation driven by vessel scarcity, bunker fuel costs, and port congestion.

This chart demonstrates the interplay between delivered price and its freight cost component across global fertilizer trade corridors.

Regional Bottlenecks and Structural Risks

Port congestion in North Africa, the Red Sea, and selected Indian destinations delayed cargoes and inflated costs.- Black Sea export uncertainty and war premiums severely impacted delivered values and contract reliability in Europe and Asia.

- Insurance and security costs reached cycle highs on high-risk routes, especially for Black Sea–Europe cargoes.

Policy and Regulatory Drivers

- Indian government intervention (import tenders, subsidy frameworks) shaped both freight market demand and price formation.

- EU environmental policy: Continues to push up logistics costs through decarbonization targets and maritime emission regimes.

- Global bunker price volatility is quickly reflected in spot freight rates, especially on longer-haul routes from the Persian Gulf and North Africa.

Outlook

Looking to year-end, the seaborne fertilizer trade faces:

- Ongoing vessel tightness due to maintenance and macro-economic pressures.

- Likely seasonal softening after Q4, but high-baseline delivered prices will persist due to insurance, security, and structural cost drivers.

- Strategic buyers continue to position cargoes and manage risk by diversifying routes and suppliers, favoring less-exposed corridors (e.g., intra-Asia, North America, select West African routes).

October 2025 Freight and Delivered Value Benchmarks by Route

| Corridor | Freight (USD/MT) | Delivered Price (USD/MT) |

|---|---|---|

| MEG→Europe | 32 | 170 |

| MEG→India | 39 | 178 |

| MEG→Africa | 35 | 174 |

| Black Sea→Europe | 48 | 185 |

| CIS→Asia | 42 | 182 |

| North America | 24 | 158 |

| Asia-Pacific | 28 | 162 |

Macroeconomics, Policy, and Regional Impacts

Global Economic Backdrop

Economic activity in October 2025 reflected a patchwork recovery across regions, with advanced economies showing slow but positive growth, while several emerging markets navigated persistent inflation and currency volatility. Energy market dynamics, shipping disruptions, and monetary tightening cycles continued to shape business sentiment and input costs across the fertilizer sector.

- Inflation: Moderated in the US and EU but remained elevated in India, Turkey, and large parts of Africa, eating into farmers' purchasing power in import-dependent regions.

- Exchange rates: The USD maintained strength throughout Q4, adding pressure to local currencies in net-importing countries such as India, Brazil, and Turkey, and amplifying fertilizer affordability risks for farmers.

- Commodities: Volatility in oil and gas prices, particularly for European gas hubs and Northeast Asian LNG, kept fertilizer production costs, especially for ammonia and nitrogen, above historical means.

Monetary and Fiscal Policy Trends

- United States & EU: The Federal Reserve and European Central Bank maintained elevated policy rates to contain inflation. Credit conditions for agribusinesses tightened, yet biofuel and crop-driven demand ensured sustained fertilizer application.

- India: Expansionary fiscal policy and a strong subsidy regime underpinned robust fertilizer demand. Trade measures, strategic stocking, and intervention in India’s northern corridor continued to drive international tenders and regional price premiums.

- China & Southeast Asia: Emphasized supply-side discipline and export quota management for select fertilizers to protect domestic affordability. Policy uncertainty surrounding China's phosphate rock exports shaped global trade flows.

- CIS & Black Sea: Localized monetary loosening was offset by logistics bottlenecks, sanctions headwinds, and geopolitical risk premiums on export freight from the region.

Policy, Subsidies, and Trade Barriers

- Subsidy Frameworks: India’s urea and complex fertilizer subsidies shielded domestic markets from full import cost pass-through, but increased outlays strained fiscal balances and delayed government reimbursements to importers.

- Tariffs and Quotas: The EU maintained carbon border adjustment mechanisms and minimum import price regimes on select products, increasing compliance costs. North Africa and CIS regions saw ad hoc export controls and seasonal trade windows.

- Environmental Policy: Decarbonization and “green ammonia” policies in the EU and select Asian countries began to influence forward demand for low-carbon fertilizers, shifting some investment toward CCS and hydrogen-linked assets.

Regional Mosaic and Market Impacts

Persian Gulf

Sustained global demand for urea and sulfur kept Persian Gulf exporters (notably Iran and Qatar) at the center of global spot trade. Persistent Red Sea and Suez transit delays affected vessel turnaround. They contributed to modest FOB declines in late October, even as FOB USD pricing remained at a competitive premium relative to other basins.

India

As the world’s largest fertilizer importer, India’s trade continued to be guided by political cycles, subsidy timing, and rural support schemes. Currency depreciation against the USD led to higher local-currency costs for importers, offset by expanded government outlays and active short-term market intervention.

China

Domestic fertilizer pricing in China decoupled from global ammonia and phosphate benchmarks due to persistent export restrictions and supply-side intervention. Regional differentials remained significant for N, P, and K fertilizers, with Asia-Pacific spot benchmarks often trading at discounts to global delivered values.

Europe

Energy crisis resolution and policy stabilization fostered a modest recovery in fertilizer demand, but high production costs and strict carbon rules continued to limit local output. Imports from CIS and North Africa helped fill supply gaps, but faced persistent freight and regulatory challenges.

CIS/Black Sea

Sanctions, uncertainty over the grain deal, and insurance-driven cost escalation continued to drive a divergence in delivered value for CIS-origin fertilizers, with cost pass-through evident among downstream regional distributors in Central Asia and Eastern Europe.

North America

Stable macro fundamentals, recovering commodity crop prices, and logistical proximity led to moderate price movements in fertilizer. Domestic-delivered values in the US and Canada benefited from low inbound freight and healthy farm-sector capitalization.

Latin America

FX volatility (notably the Brazilian real and Argentine peso) and global trade bottlenecks continued to shape procurement cycles. Fertilizer price pass-throughs to regional farmers reflected local crop economics and international currency risk.

Africa

Inflation, FX fragility, and weather risk continued to shape spot market access and logistics capacity, with Moroccan and North African exporters facing congestion at Mediterranean/Atlantic terminals but retaining shipment premiums versus Asian flows.

Key Risks and Sensitivity Analysis

- Currency Shocks: Sudden depreciation in major importers’ currencies risks pass-through to local fertilizer prices and weaker procurement cycles.

- Oil & LNG Volatility: Fertilizer production costs remain highly exposed to global energy market swings.

- Policy Shifts: Any abrupt changes in subsidy, tariff, or quota regimes—particularly in China, the EU, and India—would rapidly alter international trade flows and price formation.

- Logistics Disruptions: Geopolitical risk in the Black Sea, Suez Canal, and Red Sea will remain the leading wildcards by year-end.

Detailed Country Cases and Trade Strategies

Overview

This section profiles key fertilizer-importing and -exporting countries/regions, translating policy, currency, subsidy, logistics, and market dynamics into actionable strategies. Data visualizations and tables are included for each region, sourced from industry authorities and cross-checked with CRU, S&P Global Commodity Insights, Indian Potash Limited, ARMAITI, and Green Gubre Group analysis.

Key data and visuals:

| Region | FOB Price | Freight | Delivered | Delta MoM |

|---|---|---|---|---|

| India | 242 | 38 | 280 | +8 |

| Europe | 251 | 28 | 279 | +11 |

| China | 226 | 20 | 246 | +6 |

| Middle East | 229 | 22 | 251 | +7 |

| CIS | 215 | 25 | 240 | +5 |

India

India remains the world's largest importer of urea and complex fertilizers, underpinned by state subsidy frameworks and tender-driven volume cycles. The rupee's depreciation against the USD raised delivered costs in 2025, while government tender activity sustained import flows. Freight premiums from the Persian Gulf and CIS-Russia corridors have been volatile.

Trade strategy:

Short-term: Lock USD rates for tenders, diversify sources (MEG, CIS, China), and build buffers for Q1.

Medium-term: Advocate for streamlined subsidy payments and logistics optimization in the northern corridor.

References:

CRU Fertilizer Week,

Argus Nitrogen,

Indian Potash Limited

China & Southeast Asia

Quota management, supply-tightening policies, and price controls dominate China’s phosphate and urea trade. Exports are often restricted due to domestic priority, influencing Southeast Asian procurement cycles and delivered prices.

Trade strategy:

Short-term: Monitor Chinese export quotas, prioritize shipments ahead of regulatory windows.

Medium-term: Deepen regional distribution partnerships in ASEAN.

References:

Argus Phosphates,

S&P Global Commodity Insights

Europe

Dependent on imports from CIS, North Africa, and further afield, Europe’s fertilizer market is shaped by energy costs, emissions policy, and import tariffs. Delivered price surcharges driven by Black Sea risks and decarbonization compliance persisted through late 2025.

Trade strategy:

Short-term: Secure diversified supply to cushion gas price shocks and new carbon import regimes.

Medium-term: Develop logistics risk mapping and seek out non-CIS suppliers for resilience.

References:

Argus Nitrogen,

S&P Global Commodity Insights

CIS/Black Sea

Russian and CIS ammonium and urea exports face heavy insurance premiums and intermittent port bottlenecks. Sanctions and the deepening Black Sea conflict have fragmented corridor reliability but created spot trade arbitrage.

Trade strategy:

Short-term: Risk management through multi-corridor diversification, using Middle East and Asia-Pacific alternatives.

Medium-term: Develop regional trading hubs closer to buyers, increase FOB flexibility.

References:

ARMAITI Freight Decks,

Argus Sulphur

Middle East & North Africa

Persian Gulf and North African producers dominate the export landscape for urea, ammonia, and sulphur. In October 2025, delivered prices surged on Persian Gulf–South Asia lanes and through the Suez for North Africa. Port congestion and security surcharges drove regional price disparities.

Trade strategy:

Short-term: Focus on nearby regional markets and optimize vessel rotation.

Medium-term: Co-invest in transshipment/storage with Asian or European partners to boost market access.

References:

Argus Sulphur,

CRU Fertilizer Week

North America

Urea and ammonia domestic production supports local markets, while exports to LATAM have grown, given global price premiums. Regional logistics have benefited North American delivery prices in 2025.

Trade strategy:

Short-term: Continue hedging international freight; maintain flexibility in contract terms with key buyers.

Medium-term: Expand distribution into Mexico and South America.

References:

Argus Nitrogen,

CRU Fertilizer Week

Latin America

LatAm’s currency volatility, production cycles, and freight exposures create unique risks. Brazil and Argentina have relied on a mix of US, EU, CIS, and MEG suppliers.

Trade strategy:

Short-term: Enhance storage at import hubs to smooth FX-driven cost swings.

Medium-term: Extend supplier diversification to balance currency and freight risks.

References:

Argus Phosphates,

S&P Global Commodity Insights

Africa

Sub-Saharan Africa and North Africa experience freight congestion and supply chain delays, especially for fertilizer and sulfur delivered from the EU, the Persian Gulf, and the Black Sea.

Trade strategy:

Short-term: Use regional blending and flexible port options.

Medium-term: Develop pan-African procurement consortia for greater market leverage.

References:

CRU Fertilizer Week,

Argus Sulphur

Tables for Key Benchmark Prices

| Region | FOB Price | Freight | Delivered | Delta MoM |

|---|---|---|---|---|

| Persian Gulf | 138 | 32 | 170 | +5 |

| Europe | 157 | 20 | 177 | +9 |

| North America | 136 | 24 | 160 | +6 |

| Asia-Pacific | 134 | 28 | 162 | +4 |

Fertilizer by Product and Application

Product Overview and Segmentation

Fertilizer products are differentiated by chemical form, nutrient content (N, P, K, secondary/micronutrients), and intended crop or soil response. The main groups are urea, ammonia, ammonium sulphate, ammonium nitrate, potash (MOP/SOP), phosphate-based fertilizers (MAP, DAP, TSP), and complex NPK blends.

Major Fertilizer Products by Application Segment

- Urea: Dominant global nitrogen source, especially for cereal and row crops.

- Ammonia: Used in industrial settings, large farms, and as a feedstock for other fertilizers and chemicals.

- Ammonium Sulphate: Targeted for sulfur-deficient soils and industrial/agriculture blends.

- Ammonium Nitrate: Favored in temperate regions (Europe, CIS) and high-value vegetables/fruits.

- Potash (MOP/SOP): Critical for fruit, plantation crops, oilseeds, and soils with K deficits.

- MAP/DAP/TSP: Key for row crops, plantation crops, and high-phosphorus demand cycles.

- NPK Blends: Provide balanced nutrient solutions geared to local soil and crop needs.

References:

FAO Fertilizer Use Guide

Global Consumption Trends and Usage by Product (October 2025)

- Urea remained the leading fertilizer worldwide in October 2025, especially in Asia (India and China) and in large-scale cereal systems.

- Potash and phosphate complexes were critical for oilseeds, fruits, and export-driven plantation agriculture.

- NPK blends and specialty fertilizers continued to increase share in regions with targeted nutrient management and intensive horticulture.

References:

CRU Market Analysis,

Argus Fertilizer

Fertilizer Application: Methods and Best Practices

- Broadcast/Soil Application: Standard for dry granules (urea, potash, MAP), suited to cereals and forages. Read more from Van Iperen.

- Banding and Row Placement: Used for starter fertilizers, notably P (MAP/DAP) and N in maize, sugarcane, and wide-row crops. SoilOptix USA methods

- Fertigation/Drip Irrigation: Liquid forms (UAN solutions, NPK solubles) are prominent in high-value horticulture and greenhouse production.

- Foliar Feeding: Micronutrient top-up and specialty products for stress or deficiency correction.

- Side-dressing/Top-dressing: Mid-season N (urea, ammonium nitrate) for maize, wheat, and pasture systems.

Note: Choosing the correct application method affects nutrient efficiency, loss risk, and yield response; see

Cropnuts for in-depth examples.

Timing and Crop Fit Examples

- Urea and Ammonium Nitrate: Applied pre-plant or as top dress at rapid vegetative growth; suited for cereals, oilseeds, grasses. Bayer US crop recommendations

- MAP, DAP, TSP: Applied at planting time for root development; required for high P-demand crops and phosphorus-deficient soils; key for maize, wheat, sugar beet, potatoes.

- Potash (MOP/SOP): Split applications for fruit/vegetables and plantation crops, best for K-fixing soils or heavy rainfall areas; vital for sugarcane, potato, cotton, palms.

- NPK Blends: Custom application to local soil test results and regional cropping systems; increasingly precision-driven.

- Liquid Fertilizer Applications: Targeted for turf, ornamentals, greenhouse crops, and regional specialty systems. Greenlive guide

Observed Trends October 2025

- Global fertilizer application rates per crop generally increased for N and P (notably in corn, wheat, and soybeans). In contrast, K applications declined or stabilized due to cost and regional soil profiles. farmdoc daily

- DAP/MAP demand fluctuated with international prices and seasonal planting cycles, resulting in sharp post-harvest drops in usage in key regions.

- Substitution of NPK blends and precision-driven products increased as growers managed costs and environmental pressures.

- Africa and LATAM showed higher relative growth in NPK/specialty segment use, with mainstream NPK and P compounds lagging in regions with structural supply or subsidy constraints.

Conclusion

Core takeaways

- Global fertilizer markets in October 2025 showed persistent price discipline driven by supply-chain constraints, divergent regional policies, and evolving energy costs. Amid this, India’s subsidy-led demand, Europe’s energy-intensity constraints, and the risk of the CIS/Black Sea corridor shaped divergent price trajectories across urea, ammonium sulfate, and ammonium nitrate. These dynamics underscored the central role of logistics and policy in price formation, more than any single commodity fundamental alone.

- The strongest price signal continued to be global freight and delivered-cost premia, which amplified regional price dispersion and sharpened the incentive for buyers to optimize sourcing and hedging across corridors (Persian Gulf, Black Sea, CIS, MEG, and Atlantic routes).

- Policy and subsidy frameworks remained a critical wildcard: domestic support programs in large importers (notably India) and carbon/energy policies in Europe and Asia drove changes in both supply discipline and cost pass-through. This reinforces that near-term market outcomes depend as much on policy signaling as on raw material costs.

Integrated insights across sections

- Price formation by product remains highly corridor-dependent. Urea, AN, and AS markets reacted to shipping costs, fuel prices, insurance premiums, and regional demand drivers. Asia-Pacific and Europe continued to reflect higher delivered costs through Q4 2025, while North America benefited from relatively lower freight expenses despite domestic energy complexity.

- Trade flows are increasingly guided by flexible sourcing and regional diversification strategies. In many regions, buyers favored mixed sourcing (MEG, CIS, North Africa, and Asia-Pacific alternatives) to reduce exposure to route risk and policy shifts.

Regional outlook highlights

- Persuasive freight premiums and corridor risk remain the dominant drivers of delivered prices. Buyers should maintain hedges and multi-route strategies to mitigate volatility in CIS/Black Sea and Persian Gulf corridors.

- Policy trajectories will continue to influence demand timing and import volumes, particularly in India and Europe. Preparedness for subsidy changes, tariff adjustments, and energy policy shifts will be crucial for managing price risk.

- Longer-term structural shifts (decarbonization, green ammonia initiatives, and environmental regulation) will gradually reshape the cost structure of fertilizers, potentially favoring lower-emission supply chains and influencing investment in regional production or storage capabilities.

Practical actions for 2026 planning

1. Supply and procurement strategy

- Maintain diversified sourcing across MEG, CIS, North Africa, and Asia-Pacific corridors to mitigate corridor-specific disruptions.

- Build regional storage and blending capabilities at key hubs to smooth seasonal demand surges and currency shocks.

- Implement robust FX hedging and freight risk management for long-haul contracts with frequent tender cycles.

2. Pricing and risk management

- Use delivered-price benchmarks to set internal price bands and dynamic hedging thresholds against freight and energy cost swings.

- Monitor policy signals from major importers (India, the EU, and China) and adjust tender participation and stockholding strategies accordingly.

3. Investment and capability development

- Evaluate investments in low-emission ammonia and green fertilizer supply chains as a strategic hedge against evolving environmental policies.

- Explore strategic partnerships to improve port logistics, insurance arrangements, and corridor reliability.