Controlled-Release Fertilizers in Climate-Smart Agriculture – Innovation for Resilient Yields

Controlled-Release Fertilizers in Climate-Smart Agriculture-Innovation for Resilient Yields

Introduction: Climate Change Demands Smarter Fertilizer

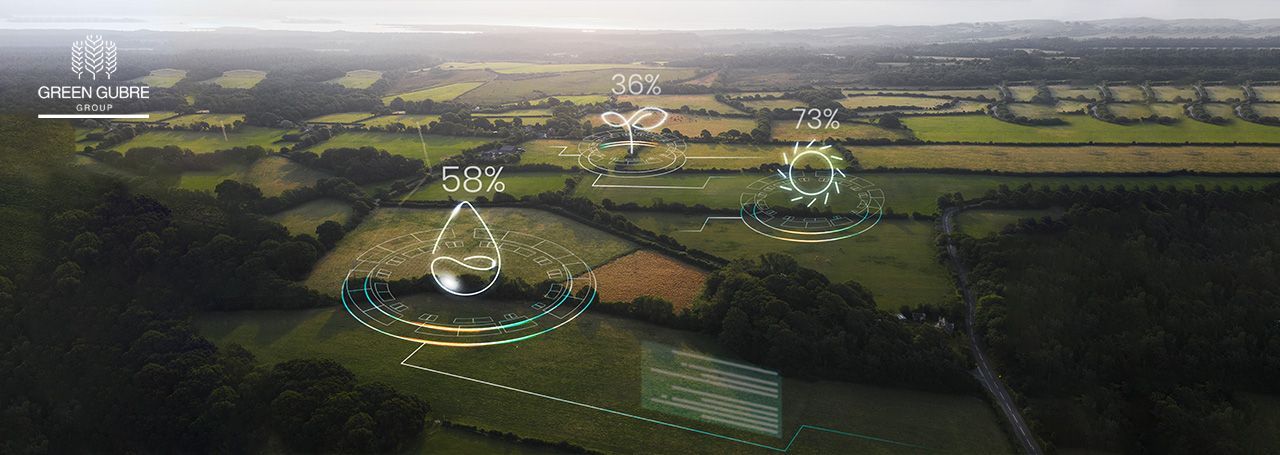

As climate variability intensifies across the globe, through unpredictable rainfall, droughts, and soil degradation, agriculture must adapt. One of the most effective tools for ensuring yield stability while protecting the environment is Controlled-Release Fertilizer (CRF).

In 2025, CRFs are at the center of climate-smart agriculture strategies. With increasing adoption in Asia, Africa, and Latin America, CRFs help reduce nitrogen loss, extend nutrient availability, and improve crop resilience in a changing climate. This blog explores CRF technology, market growth, and its role in sustainable food systems.

1. What Are Controlled-Release Fertilizers?

Controlled-release fertilizers are coated or chemically modified nutrient granules that release nutrients gradually over time, matching plant demand and reducing environmental losses.

Types of CRFs:

- Polymer-coated urea (PCU)

- Sulfur-coated urea (SCU)

- Urease or nitrification inhibitor blends

- Nanotechnology-based encapsulated nutrients

Benefits:

- 30–50% less nitrogen loss via leaching and volatilization

- Improved nitrogen use efficiency (NUE)

- Reduced greenhouse gas emissions

- Enhanced yields under erratic weather

2. Why CRFs Matter for Climate-Smart Farming

- In Drought-Prone Regions: CRFs reduce the need for frequent topdressing, conserving water and labor.

- In Flood Zones, Nutrients are protected from rapid runoff during heavy rainfall.

- In Arid Soils: CRFs enable longer nutrient retention, improving fertility under poor soil structure.

- In High-Temperature Zones: Slow-release helps prevent volatilization loss.

- Case Study—India: The use of sulfur-coated urea in maize and rice trials showed a 15–25% increase in yield and a 35% reduction in nitrogen application rates.

3. Global Market Trends in 2025

The global CRF market is growing rapidly, projected to exceed $5.8 billion by 2026, driven by:

- Government incentives (e.g., India, EU)

- Water scarcity and climate adaptation efforts

- Premium crop segments (e.g., horticulture, coffee, vineyards)

| Region | Key Trend |

|---|---|

| Asia | India mandates CRF trials; China uses PCU in rice paddies |

| Africa | Trials in Kenya and Ghana for vegetables and maize |

| Latin America | Brazil expands PCU in sugarcane and soybean |

| Europe | CBAM pressure encourages a switch to CRF for low-emission farming |

4. Challenges and Solutions

While CRFs offer clear benefits, adoption faces certain hurdles:

| Challenge | Solution |

|---|---|

| High cost per kg | Cost-sharing programs, blending with conventional urea |

| Lack of farmer awareness | Demo plots, agro-extension training |

| Limited availability in rural areas | Partner with cooperatives, mobile distributors |

| Policy and certification barriers | Work with regulators to integrate CRFs into national fertilizer plans |

5. Strategic Opportunity for Suppliers and Traders

Suppliers can gainan early-mover advantage by:

- Launching blended fertilizers (e.g., CRF + micronutrient NPK)

- Offering coated options for key crops like maize, cocoa, or citrus

- Supporting government tenders with sustainability metrics

- Promoting

CBAM-compliant products for export

Pro Tip: Market CRFs as a climate resilience solution, not just a fertilizer.

Conclusion: Fertilizer for the Climate Era

Controlled-release fertilizers are more than a technical upgrade—they’re a resilience tool for agriculture in the climate era. They allow crops to thrive under stress, optimize nutrient uptake, and reduce emissions. For farmers, traders, and governments seeking long-term food security and environmental protection, CRFs are a strategic asset for 2025 and beyond.